- Malaysia

- /

- Basic Materials

- /

- KLSE:XIN

Investors Appear Satisfied With Xin Synergy Group Berhad's (KLSE:XIN) Prospects As Shares Rocket 29%

Xin Synergy Group Berhad (KLSE:XIN) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 36%.

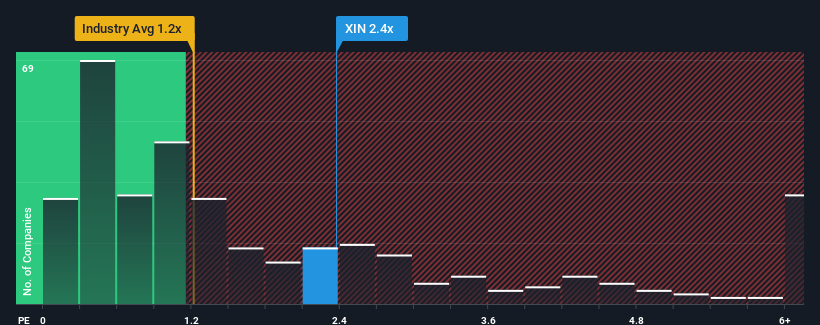

Since its price has surged higher, you could be forgiven for thinking Xin Synergy Group Berhad is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in Malaysia's Basic Materials industry have P/S ratios below 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Xin Synergy Group Berhad

How Has Xin Synergy Group Berhad Performed Recently?

Xin Synergy Group Berhad certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Xin Synergy Group Berhad will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Xin Synergy Group Berhad?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Xin Synergy Group Berhad's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 39%. The strong recent performance means it was also able to grow revenue by 94% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 3.6%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Xin Synergy Group Berhad's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Xin Synergy Group Berhad's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Xin Synergy Group Berhad revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 3 warning signs for Xin Synergy Group Berhad that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:XIN

Xin Synergy Group Berhad

An investment holding company, manufactures and supply asphaltic concrete and aggregates primarily in Malaysia.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026