- Malaysia

- /

- Metals and Mining

- /

- KLSE:WENTEL

Wentel Engineering Holdings Berhad (KLSE:WENTEL) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Wentel Engineering Holdings Berhad (KLSE:WENTEL) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 18% over that time.

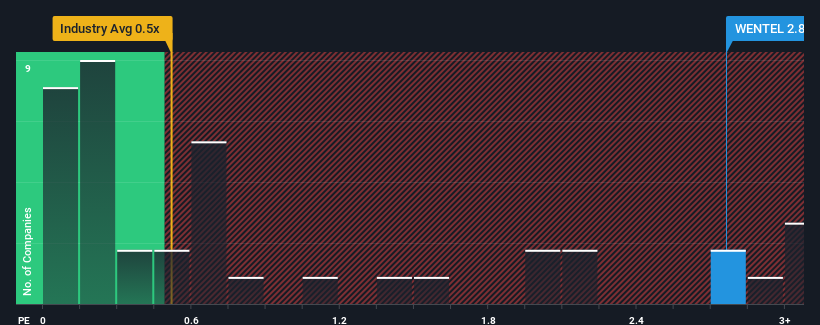

Following the firm bounce in price, when almost half of the companies in Malaysia's Metals and Mining industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Wentel Engineering Holdings Berhad as a stock not worth researching with its 2.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Wentel Engineering Holdings Berhad

How Has Wentel Engineering Holdings Berhad Performed Recently?

Wentel Engineering Holdings Berhad has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Wentel Engineering Holdings Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Wentel Engineering Holdings Berhad?

The only time you'd be truly comfortable seeing a P/S as steep as Wentel Engineering Holdings Berhad's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The latest three year period has also seen a 25% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 13% shows it's noticeably less attractive.

In light of this, it's alarming that Wentel Engineering Holdings Berhad's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Shares in Wentel Engineering Holdings Berhad have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Wentel Engineering Holdings Berhad currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 3 warning signs for Wentel Engineering Holdings Berhad (1 can't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Wentel Engineering Holdings Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wentel Engineering Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WENTEL

Wentel Engineering Holdings Berhad

Through its subsidiaries, engages in the fabrication of semifinished metal products and metal parts in Malaysia, Singapore, and the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026