If You Had Bought Tomypak Holdings Berhad (KLSE:TOMYPAK) Shares A Year Ago You'd Have Earned 53% Returns

It hasn't been the best quarter for Tomypak Holdings Berhad (KLSE:TOMYPAK) shareholders, since the share price has fallen 11% in that time. But looking back over the last year, the returns have actually been rather pleasing! Looking at the full year, the company has easily bested an index fund by gaining 53%.

Check out our latest analysis for Tomypak Holdings Berhad

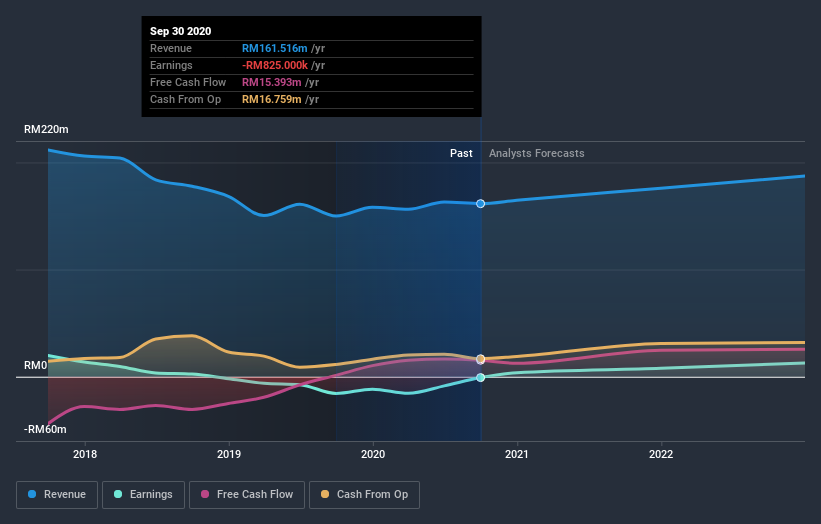

Tomypak Holdings Berhad isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Tomypak Holdings Berhad's revenue grew by 7.6%. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably largely reflected in the share price, which is up 53%. That's not a standout result, but it is solid - much like the level of revenue growth. It could be worth keeping an eye on this one, especially if growth accelerates.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Tomypak Holdings Berhad stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Tomypak Holdings Berhad shareholders have received a total shareholder return of 53% over one year. That's better than the annualised return of 2% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Tomypak Holdings Berhad that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Tomypak Holdings Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tomypak Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:TOMYPAK

Tomypak Holdings Berhad

An investment holding company, engages in the manufacture and marketing of flexible and industrial packaging materials for food and beverage companies in Malaysia and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026