Techbond Group Berhad's (KLSE:TECHBND) earnings trajectory could turn positive as the stock spikes 13% this past week

It's nice to see the Techbond Group Berhad (KLSE:TECHBND) share price up 13% in a week. But in truth the last year hasn't been good for the share price. After all, the share price is down 45% in the last year, significantly under-performing the market.

The recent uptick of 13% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

See our latest analysis for Techbond Group Berhad

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

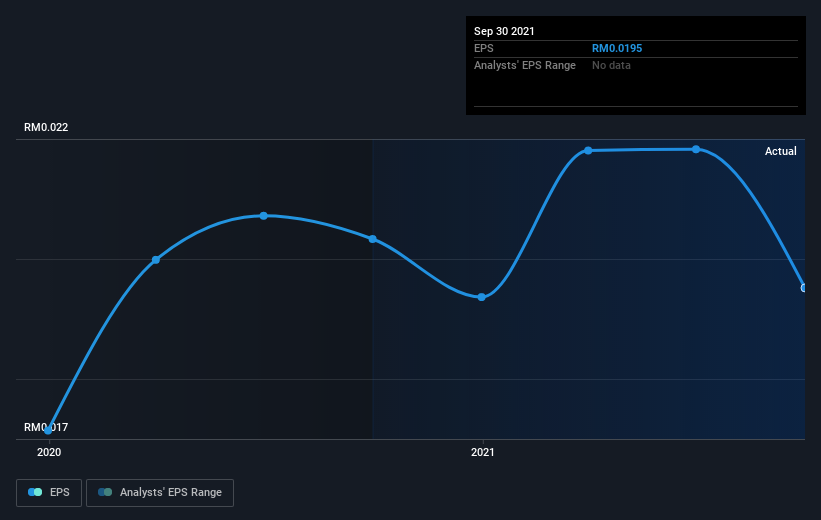

Unhappily, Techbond Group Berhad had to report a 4.0% decline in EPS over the last year. The share price decline of 45% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Techbond Group Berhad's earnings, revenue and cash flow.

A Different Perspective

Techbond Group Berhad shareholders are down 45% for the year, (even including dividends), but the broader market is up 0.2%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Investors are up over three years, booking 1.0% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. It's always interesting to track share price performance over the longer term. But to understand Techbond Group Berhad better, we need to consider many other factors. For example, we've discovered 3 warning signs for Techbond Group Berhad (1 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Techbond Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TECHBND

Techbond Group Berhad

Develops, manufactures, and trades in industrial adhesives and sealants in Malaysia, Vietnam, Indonesia, Thailand, China, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026