What Can We Learn About Southern Acids (M) Berhad's (KLSE:SAB) CEO Compensation?

This article will reflect on the compensation paid to Nick Low who has served as CEO of Southern Acids (M) Berhad (KLSE:SAB) since 2015. This analysis will also assess whether Southern Acids (M) Berhad pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Southern Acids (M) Berhad

How Does Total Compensation For Nick Low Compare With Other Companies In The Industry?

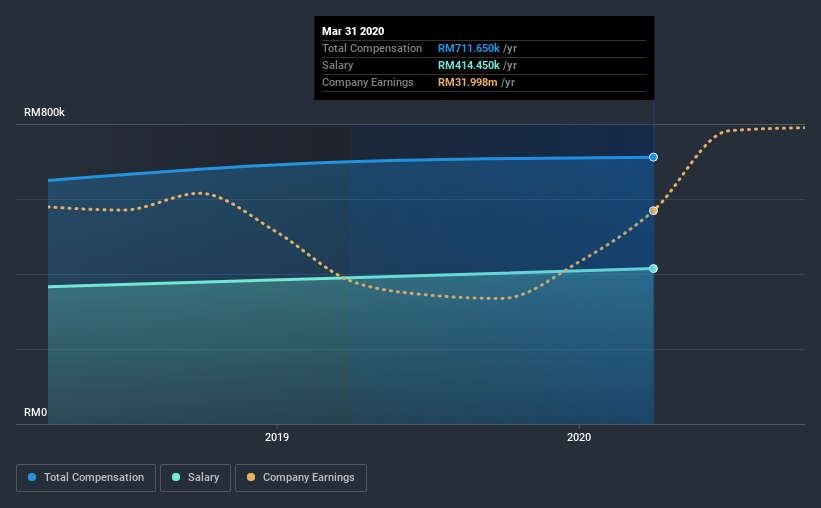

At the time of writing, our data shows that Southern Acids (M) Berhad has a market capitalization of RM531m, and reported total annual CEO compensation of RM712k for the year to March 2020. This means that the compensation hasn't changed much from last year. Notably, the salary which is RM414.5k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below RM811m, reported a median total CEO compensation of RM737k. From this we gather that Nick Low is paid around the median for CEOs in the industry. Furthermore, Nick Low directly owns RM364k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM414k | RM390k | 58% |

| Other | RM297k | RM309k | 42% |

| Total Compensation | RM712k | RM699k | 100% |

Speaking on an industry level, nearly 59% of total compensation represents salary, while the remainder of 41% is other remuneration. There isn't a significant difference between Southern Acids (M) Berhad and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Southern Acids (M) Berhad's Growth

Southern Acids (M) Berhad saw earnings per share stay pretty flat over the last three years. Its revenue is up 14% over the last year.

A lack of EPS improvement is not good to see. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that EPS has gone backwards over three years. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Southern Acids (M) Berhad Been A Good Investment?

With a three year total loss of 6.4% for the shareholders, Southern Acids (M) Berhad would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we touched on above, Southern Acids (M) Berhad is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. We'd stop short of saying compensation is inappropriate, but we would understand if shareholders had questions regarding a future raise.

So you may want to check if insiders are buying Southern Acids (M) Berhad shares with their own money (free access).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Southern Acids (M) Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:SAB

Southern Acids (M) Berhad

An investment holding company, engages in the manufacture and trading of oleochemical products in Malaysia, Indonesia, Asia, Europe, the United States, and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026