- Malaysia

- /

- Metals and Mining

- /

- KLSE:PMBTECH

PMB Technology Berhad's (KLSE:PMBTECH) Share Price Could Signal Some Risk

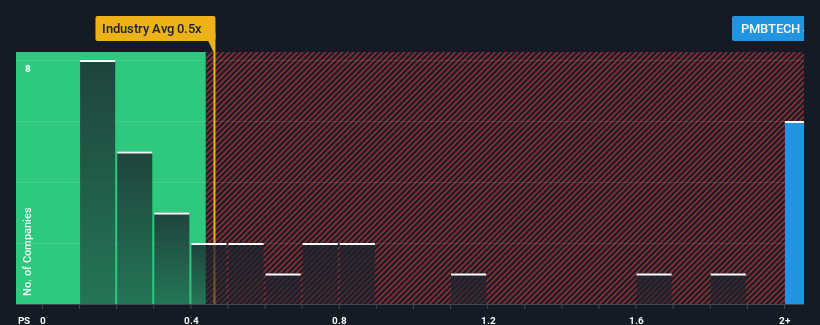

When you see that almost half of the companies in the Metals and Mining industry in Malaysia have price-to-sales ratios (or "P/S") below 0.5x, PMB Technology Berhad (KLSE:PMBTECH) looks to be giving off strong sell signals with its 4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for PMB Technology Berhad

What Does PMB Technology Berhad's Recent Performance Look Like?

Recent times haven't been great for PMB Technology Berhad as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on PMB Technology Berhad will help you uncover what's on the horizon.How Is PMB Technology Berhad's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as PMB Technology Berhad's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 106% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.4% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 3.5%, which is not materially different.

In light of this, it's curious that PMB Technology Berhad's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Analysts are forecasting PMB Technology Berhad's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 3 warning signs for PMB Technology Berhad (of which 1 is a bit concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PMBTECH

PMB Technology Berhad

An investment holding company, produces and distributes metallic silicon and aluminium related products in Malaysia, other Asian countries, and internationally.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion