- Malaysia

- /

- Metals and Mining

- /

- KLSE:PMBTECH

One Analyst Just Shaved Their PMB Technology Berhad (KLSE:PMBTECH) Forecasts Dramatically

The latest analyst coverage could presage a bad day for PMB Technology Berhad (KLSE:PMBTECH), with the covering analyst making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analyst seeing grey clouds on the horizon.

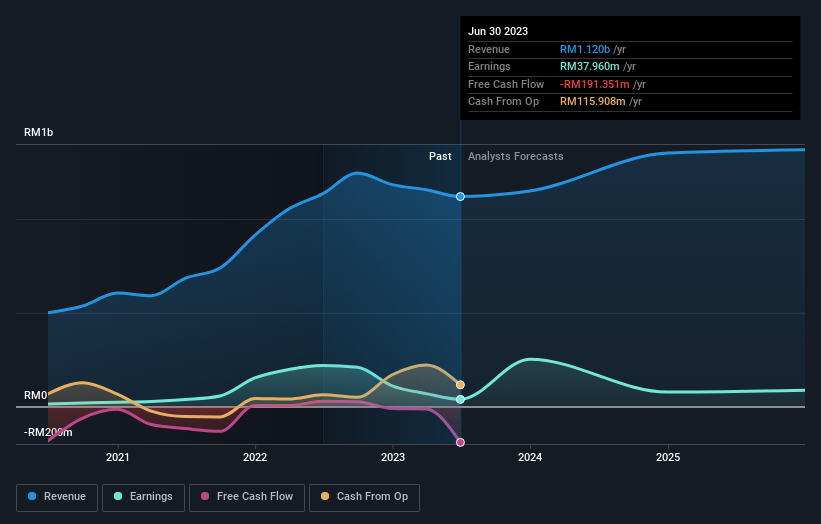

Following the downgrade, the most recent consensus for PMB Technology Berhad from its lone analyst is for revenues of RM1.1b in 2023 which, if met, would be a satisfactory 2.7% increase on its sales over the past 12 months. Statutory earnings per share are forecast to be RM0.024, approximately in line with the last 12 months. Before this latest update, the analyst had been forecasting revenues of RM1.6b and earnings per share (EPS) of RM0.21 in 2023. Indeed, we can see that the analyst is a lot more bearish about PMB Technology Berhad's prospects, administering a pretty serious reduction to revenue estimates and slashing their EPS estimates to boot.

Check out our latest analysis for PMB Technology Berhad

The consensus price target fell 69% to RM1.11, with the weaker earnings outlook clearly leading analyst valuation estimates.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that PMB Technology Berhad's revenue growth will slow down substantially, with revenues to the end of 2023 expected to display 2.7% growth on an annualised basis. This is compared to a historical growth rate of 30% over the past five years. Compare this to the 34 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 3.0% per year. So it's pretty clear that, while PMB Technology Berhad's revenue growth is expected to slow, it's expected to grow roughly in line with the industry.

The Bottom Line

The most important thing to take away is that the analyst cut their earnings per share estimates, expecting a clear decline in business conditions. There was also a drop in their revenue estimates, although as we saw earlier, forecast growth is only expected to be about the same as the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of PMB Technology Berhad.

As you can see, this analyst clearly isn't bullish, and there might be good reason for that. We've identified some potential issues with PMB Technology Berhad's financials, such as its declining profit margins. For more information, you can click here to discover this and the 2 other risks we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PMBTECH

PMB Technology Berhad

An investment holding company, produces and distributes metallic silicon and aluminium related products in Malaysia, other Asian countries, and internationally.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion