- Malaysia

- /

- Metals and Mining

- /

- KLSE:PANTECH

Shareholders Would Not Be Objecting To Pantech Group Holdings Berhad's (KLSE:PANTECH) CEO Compensation And Here's Why

Key Insights

- Pantech Group Holdings Berhad will host its Annual General Meeting on 30th of July

- Total pay for CEO Jimmy Chew includes RM534.0k salary

- The total compensation is similar to the average for the industry

- Over the past three years, Pantech Group Holdings Berhad's EPS grew by 53% and over the past three years, the total shareholder return was 162%

The performance at Pantech Group Holdings Berhad (KLSE:PANTECH) has been quite strong recently and CEO Jimmy Chew has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 30th of July. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

Check out our latest analysis for Pantech Group Holdings Berhad

How Does Total Compensation For Jimmy Chew Compare With Other Companies In The Industry?

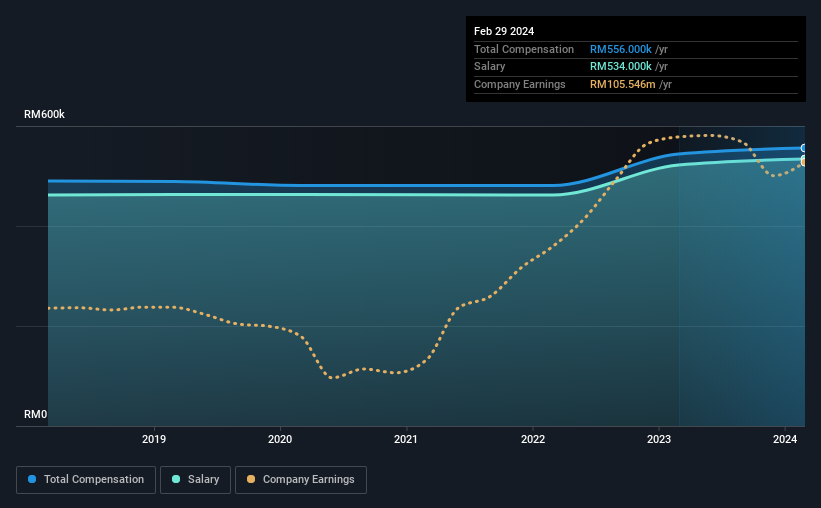

According to our data, Pantech Group Holdings Berhad has a market capitalization of RM932m, and paid its CEO total annual compensation worth RM556k over the year to February 2024. That's mostly flat as compared to the prior year's compensation. In particular, the salary of RM534.0k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the Malaysian Metals and Mining industry with market capitalizations between RM467m and RM1.9b, we discovered that the median CEO total compensation of that group was RM578k. So it looks like Pantech Group Holdings Berhad compensates Jimmy Chew in line with the median for the industry. What's more, Jimmy Chew holds RM14m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM534k | RM522k | 96% |

| Other | RM22k | RM22k | 4% |

| Total Compensation | RM556k | RM544k | 100% |

Talking in terms of the industry, salary represented approximately 70% of total compensation out of all the companies we analyzed, while other remuneration made up 30% of the pie. Investors will find it interesting that Pantech Group Holdings Berhad pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Pantech Group Holdings Berhad's Growth Numbers

Pantech Group Holdings Berhad has seen its earnings per share (EPS) increase by 53% a year over the past three years. Its revenue is down 8.8% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Pantech Group Holdings Berhad Been A Good Investment?

Boasting a total shareholder return of 162% over three years, Pantech Group Holdings Berhad has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Jimmy receives almost all of their compensation through a salary. The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Pantech Group Holdings Berhad that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:PANTECH

Pantech Group Holdings Berhad

An investment holding company, manufactures and sells steel pipes, fittings, flanges, valves, and other related products in Malaysia, the Republic of Singapore, the United Kingdom.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026