- Malaysia

- /

- Metals and Mining

- /

- KLSE:PA

While shareholders of P.A. Resources Berhad (KLSE:PA) are in the black over 5 years, those who bought a week ago aren't so fortunate

It might be of some concern to shareholders to see the P.A. Resources Berhad (KLSE:PA) share price down 19% in the last month. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 182% higher today. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Of course, that doesn't necessarily mean it's cheap now.

In light of the stock dropping 14% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

See our latest analysis for P.A. Resources Berhad

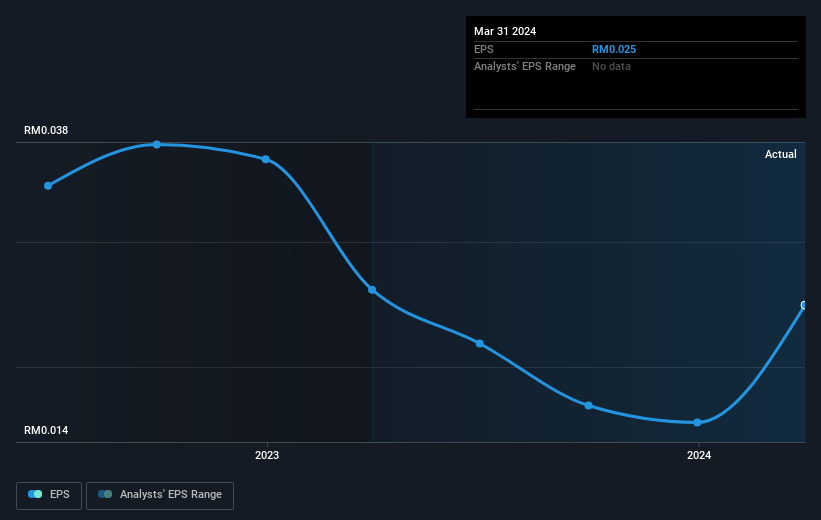

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, P.A. Resources Berhad became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the P.A. Resources Berhad share price is down 14% in the last three years. In the same period, EPS is up 11% per year. So there seems to be a mismatch between the positive EPS growth and the change in the share price, which is down -5% per year.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into P.A. Resources Berhad's key metrics by checking this interactive graph of P.A. Resources Berhad's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for P.A. Resources Berhad the TSR over the last 5 years was 200%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that P.A. Resources Berhad shareholders have received a total shareholder return of 23% over the last year. And that does include the dividend. However, that falls short of the 25% TSR per annum it has made for shareholders, each year, over five years. It's always interesting to track share price performance over the longer term. But to understand P.A. Resources Berhad better, we need to consider many other factors. For example, we've discovered 1 warning sign for P.A. Resources Berhad that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:PA

P.A. Resources Berhad

An investment holding company, provides aluminum extrusion, fabrication, and related services primarily in Malaysia and the United States.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives