- Malaysia

- /

- Metals and Mining

- /

- KLSE:MYCRON

Mycron Steel Berhad's (KLSE:MYCRON) 27% Price Boost Is Out Of Tune With Revenues

Mycron Steel Berhad (KLSE:MYCRON) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 41%.

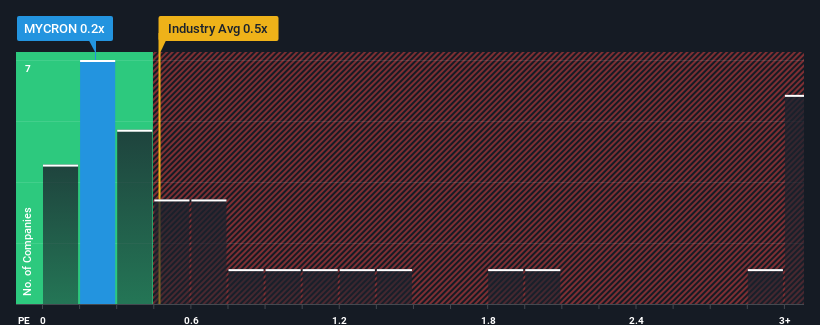

Even after such a large jump in price, there still wouldn't be many who think Mycron Steel Berhad's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Malaysia's Metals and Mining industry is similar at about 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Mycron Steel Berhad

What Does Mycron Steel Berhad's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Mycron Steel Berhad has been doing very well. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Mycron Steel Berhad's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Mycron Steel Berhad's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 31%. As a result, it also grew revenue by 7.2% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to deliver 9.0% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Mycron Steel Berhad's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From Mycron Steel Berhad's P/S?

Its shares have lifted substantially and now Mycron Steel Berhad's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Mycron Steel Berhad revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Mycron Steel Berhad that you need to be mindful of.

If these risks are making you reconsider your opinion on Mycron Steel Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MYCRON

Mycron Steel Berhad

An investment holding company, manufactures, trades in, and sells mid-stream steel cold rolled coils and steel tubes in Malaysia.

Excellent balance sheet and good value.

Market Insights

Community Narratives