These 4 Measures Indicate That Muda Holdings Berhad (KLSE:MUDA) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Muda Holdings Berhad (KLSE:MUDA) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Muda Holdings Berhad

What Is Muda Holdings Berhad's Net Debt?

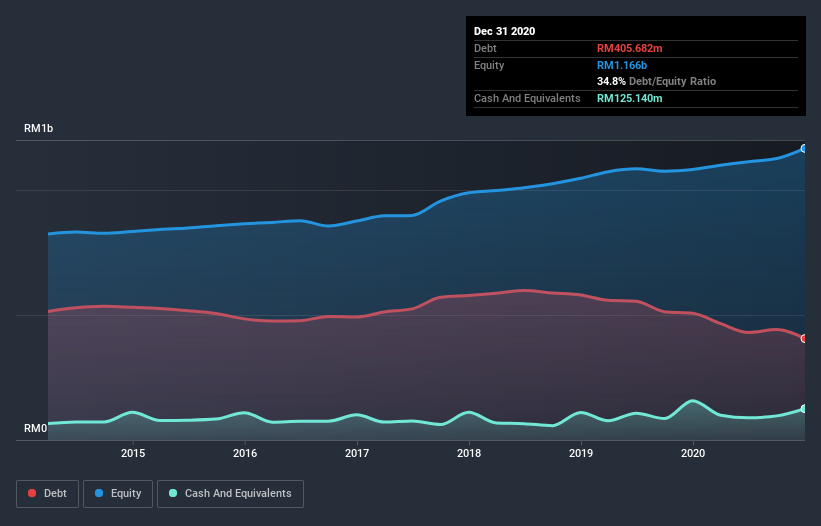

The image below, which you can click on for greater detail, shows that Muda Holdings Berhad had debt of RM405.7m at the end of December 2020, a reduction from RM507.0m over a year. However, because it has a cash reserve of RM125.1m, its net debt is less, at about RM280.5m.

How Healthy Is Muda Holdings Berhad's Balance Sheet?

We can see from the most recent balance sheet that Muda Holdings Berhad had liabilities of RM518.2m falling due within a year, and liabilities of RM256.1m due beyond that. Offsetting this, it had RM125.1m in cash and RM321.1m in receivables that were due within 12 months. So its liabilities total RM328.0m more than the combination of its cash and short-term receivables.

Muda Holdings Berhad has a market capitalization of RM835.8m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 1.3 and interest cover of 6.8 times, it seems to us that Muda Holdings Berhad is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Also positive, Muda Holdings Berhad grew its EBIT by 23% in the last year, and that should make it easier to pay down debt, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Muda Holdings Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Muda Holdings Berhad's free cash flow amounted to 42% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

When it comes to the balance sheet, the standout positive for Muda Holdings Berhad was the fact that it seems able to grow its EBIT confidently. But the other factors we noted above weren't so encouraging. For example, its level of total liabilities makes us a little nervous about its debt. Considering this range of data points, we think Muda Holdings Berhad is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Muda Holdings Berhad has 2 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Muda Holdings Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MUDA

Muda Holdings Berhad

An investment holding company, engages in the manufacture and sale of paper and paper packaging products in Malaysia, Singapore, Australia, and the People’s Republic of China.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.