- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:MENTIGA

Is Mentiga Corporation Berhad (KLSE:MENTIGA) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Mentiga Corporation Berhad (KLSE:MENTIGA) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Mentiga Corporation Berhad

What Is Mentiga Corporation Berhad's Debt?

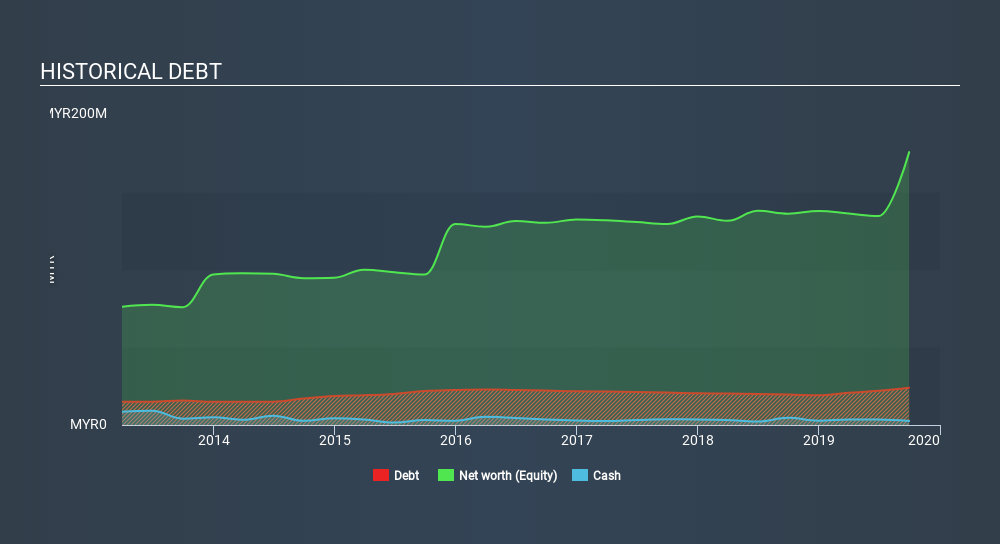

You can click the graphic below for the historical numbers, but it shows that as of September 2019 Mentiga Corporation Berhad had RM24.0m of debt, an increase on RM19.6m, over one year. However, it does have RM2.62m in cash offsetting this, leading to net debt of about RM21.3m.

A Look At Mentiga Corporation Berhad's Liabilities

Zooming in on the latest balance sheet data, we can see that Mentiga Corporation Berhad had liabilities of RM22.0m due within 12 months and liabilities of RM59.5m due beyond that. Offsetting this, it had RM2.62m in cash and RM932.0k in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM78.0m.

The deficiency here weighs heavily on the RM35.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Mentiga Corporation Berhad would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Mentiga Corporation Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Mentiga Corporation Berhad had negative earnings before interest and tax, and actually shrunk its revenue by 43%, to RM9.8m. To be frank that doesn't bode well.

Caveat Emptor

While Mentiga Corporation Berhad's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at RM2.6m. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it burned through RM6.2m in negative free cash flow over the last year. So suffice it to say we consider the stock to be risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Mentiga Corporation Berhad is showing 3 warning signs in our investment analysis , and 2 of those can't be ignored...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:MENTIGA

Mentiga Corporation Berhad

An investment holding company, engages in the oil palm plantation business in Malaysia.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives