Luster Industries Bhd (KLSE:LUSTER) Has Debt But No Earnings; Should You Worry?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Luster Industries Bhd (KLSE:LUSTER) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Luster Industries Bhd

How Much Debt Does Luster Industries Bhd Carry?

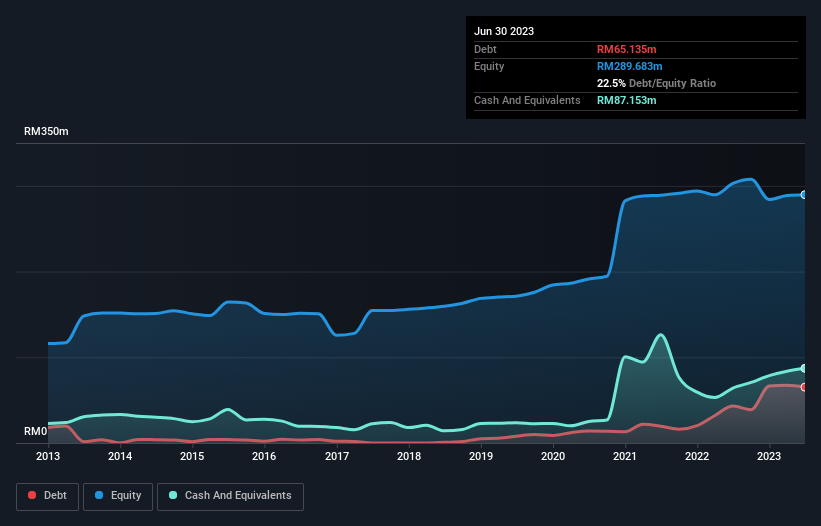

You can click the graphic below for the historical numbers, but it shows that as of June 2023 Luster Industries Bhd had RM65.1m of debt, an increase on RM43.1m, over one year. But it also has RM87.2m in cash to offset that, meaning it has RM22.0m net cash.

How Healthy Is Luster Industries Bhd's Balance Sheet?

We can see from the most recent balance sheet that Luster Industries Bhd had liabilities of RM144.6m falling due within a year, and liabilities of RM120.0m due beyond that. Offsetting these obligations, it had cash of RM87.2m as well as receivables valued at RM64.3m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM113.1m.

This deficit isn't so bad because Luster Industries Bhd is worth RM196.5m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Despite its noteworthy liabilities, Luster Industries Bhd boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is Luster Industries Bhd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Luster Industries Bhd made a loss at the EBIT level, and saw its revenue drop to RM153m, which is a fall of 3.5%. That's not what we would hope to see.

So How Risky Is Luster Industries Bhd?

Although Luster Industries Bhd had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of RM210k. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Luster Industries Bhd has 3 warning signs (and 1 which is significant) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LUSTER

Luster Industries Bhd

An investment holding company, manufactures and sells plastic molded components in Malaysia, the United Kingdom, the Asia-Pacific, the United States, Germany, New Zealand, Saudi Arabia, South Africa, Chile, Kenya, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success