Here's Why Luster Industries Bhd (KLSE:LUSTER) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Luster Industries Bhd (KLSE:LUSTER) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Luster Industries Bhd

How Much Debt Does Luster Industries Bhd Carry?

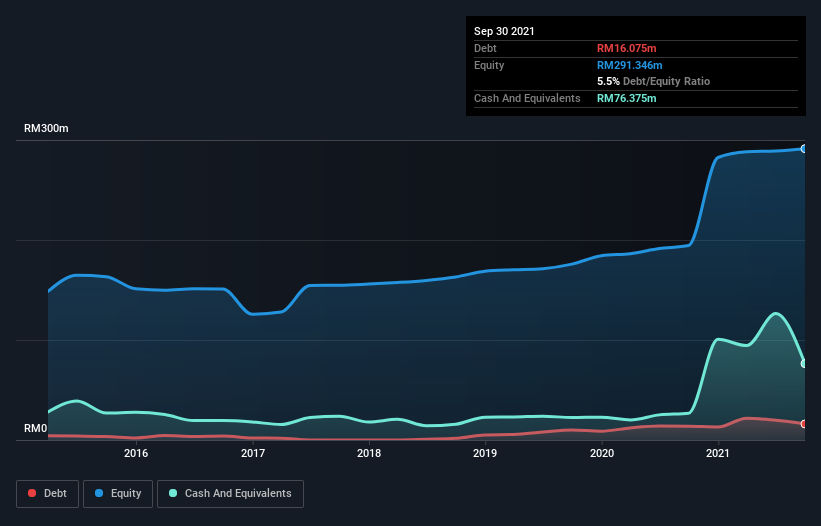

You can click the graphic below for the historical numbers, but it shows that as of September 2021 Luster Industries Bhd had RM16.1m of debt, an increase on RM13.8m, over one year. However, it does have RM76.4m in cash offsetting this, leading to net cash of RM60.3m.

How Healthy Is Luster Industries Bhd's Balance Sheet?

The latest balance sheet data shows that Luster Industries Bhd had liabilities of RM111.3m due within a year, and liabilities of RM40.0m falling due after that. Offsetting these obligations, it had cash of RM76.4m as well as receivables valued at RM176.9m due within 12 months. So it actually has RM101.9m more liquid assets than total liabilities.

This surplus suggests that Luster Industries Bhd is using debt in a way that is appears to be both safe and conservative. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that Luster Industries Bhd has more cash than debt is arguably a good indication that it can manage its debt safely.

Also good is that Luster Industries Bhd grew its EBIT at 20% over the last year, further increasing its ability to manage debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Luster Industries Bhd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Luster Industries Bhd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Luster Industries Bhd burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

While it is always sensible to investigate a company's debt, in this case Luster Industries Bhd has RM60.3m in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 20% over the last year. So we are not troubled with Luster Industries Bhd's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Luster Industries Bhd you should be aware of, and 1 of them is a bit unpleasant.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LUSTER

Luster Industries Bhd

An investment holding company, manufactures and sells plastic molded components in Malaysia, the United Kingdom, the Asia-Pacific, the United States, Germany, New Zealand, Saudi Arabia, South Africa, Chile, Kenya, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success