- Malaysia

- /

- Basic Materials

- /

- KLSE:KIALIM

Kia Lim Berhad (KLSE:KIALIM) Shares Fly 26% But Investors Aren't Buying For Growth

Those holding Kia Lim Berhad (KLSE:KIALIM) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 50% share price decline over the last year.

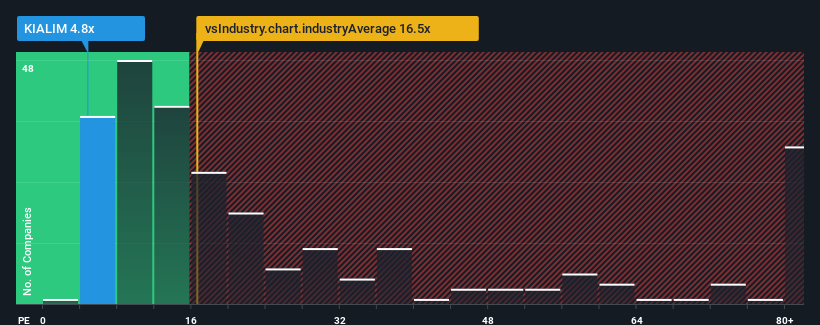

Even after such a large jump in price, Kia Lim Berhad's price-to-earnings (or "P/E") ratio of 4.8x might still make it look like a strong buy right now compared to the market in Malaysia, where around half of the companies have P/E ratios above 15x and even P/E's above 26x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Our free stock report includes 2 warning signs investors should be aware of before investing in Kia Lim Berhad. Read for free now.The earnings growth achieved at Kia Lim Berhad over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Kia Lim Berhad

Is There Any Growth For Kia Lim Berhad?

The only time you'd be truly comfortable seeing a P/E as depressed as Kia Lim Berhad's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 17%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 16% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Kia Lim Berhad's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Kia Lim Berhad's P/E?

Shares in Kia Lim Berhad are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Kia Lim Berhad revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Kia Lim Berhad that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Kia Lim Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KIALIM

Kia Lim Berhad

An investment holding company, engages in the manufacture and sale of clay bricks and related products in Malaysia and Singapore.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.