Revenues Not Telling The Story For Hextar Global Berhad (KLSE:HEXTAR) After Shares Rise 25%

Hextar Global Berhad (KLSE:HEXTAR) shareholders have had their patience rewarded with a 25% share price jump in the last month. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

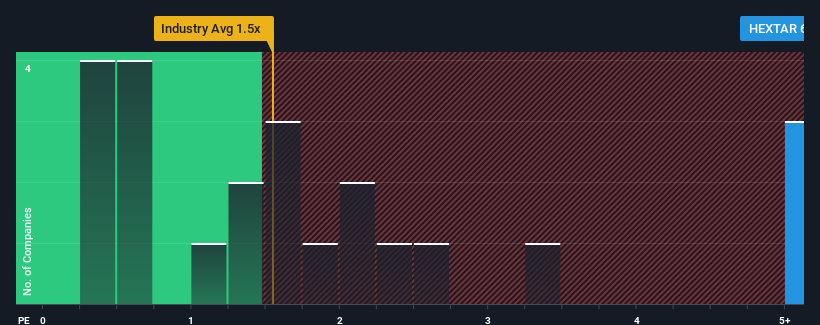

After such a large jump in price, when almost half of the companies in Malaysia's Chemicals industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Hextar Global Berhad as a stock not worth researching with its 6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Hextar Global Berhad

What Does Hextar Global Berhad's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Hextar Global Berhad has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hextar Global Berhad.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Hextar Global Berhad's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 53% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 2.3% during the coming year according to the two analysts following the company. That's shaping up to be similar to the 0.5% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Hextar Global Berhad's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

The strong share price surge has lead to Hextar Global Berhad's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given Hextar Global Berhad's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Hextar Global Berhad that you need to be mindful of.

If these risks are making you reconsider your opinion on Hextar Global Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hextar Global Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HEXTAR

Hextar Global Berhad

An investment holding company, engages in manufacturing, trading, and distribution of a various agrochemicals and fertilisers in Malaysia.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives