- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:GPHAROS

Does Golden Pharos Berhad (KLSE:GPHAROS) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Golden Pharos Berhad (KLSE:GPHAROS) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Golden Pharos Berhad

What Is Golden Pharos Berhad's Debt?

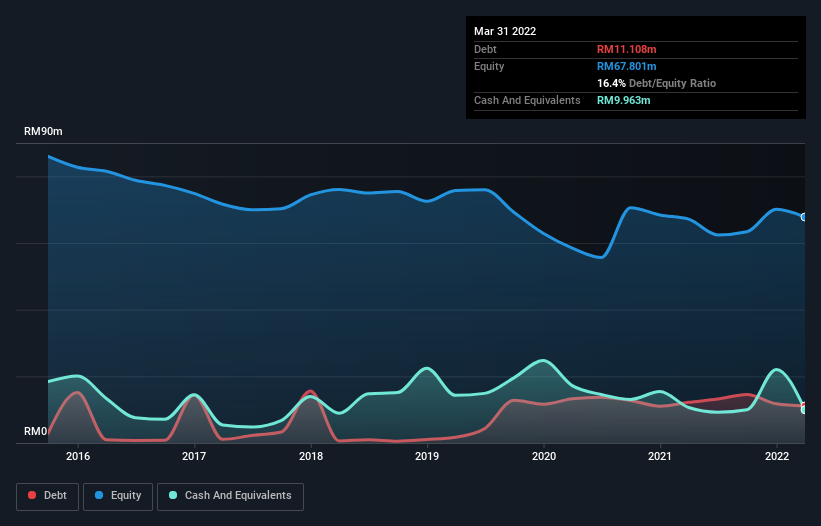

The image below, which you can click on for greater detail, shows that Golden Pharos Berhad had debt of RM11.1m at the end of March 2022, a reduction from RM12.2m over a year. However, because it has a cash reserve of RM9.96m, its net debt is less, at about RM1.15m.

How Healthy Is Golden Pharos Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Golden Pharos Berhad had liabilities of RM16.9m due within 12 months and liabilities of RM15.5m due beyond that. Offsetting these obligations, it had cash of RM9.96m as well as receivables valued at RM19.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM2.99m.

Given Golden Pharos Berhad has a market capitalization of RM32.3m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Golden Pharos Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Golden Pharos Berhad's revenue was pretty flat, and it made a negative EBIT. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Importantly, Golden Pharos Berhad had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at RM1.1m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled RM344k in negative free cash flow over the last twelve months. So to be blunt we think it is risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for Golden Pharos Berhad (3 are a bit concerning) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:GPHAROS

Golden Pharos Berhad

An investment holding company, primarily engages in the forest concession management, harvesting, distribution, sawmilling, and processing of wood-based products in Malaysia and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026