- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:EVERGRN

Evergreen Fibreboard Berhad (KLSE:EVERGRN) Could Be Riskier Than It Looks

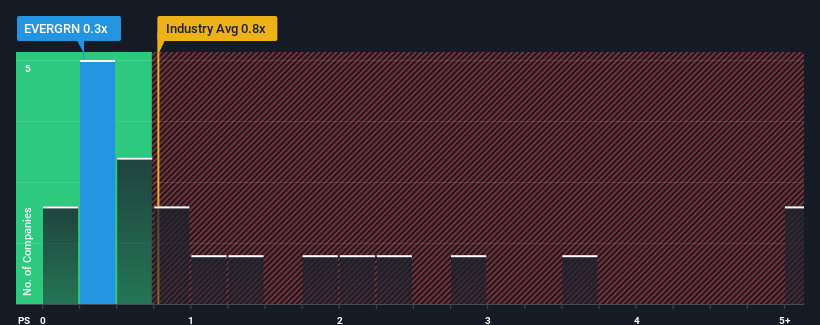

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Evergreen Fibreboard Berhad (KLSE:EVERGRN) is a stock worth checking out, seeing as almost half of all the Forestry companies in Malaysia have P/S ratios greater than 0.8x and even P/S higher than 3x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Evergreen Fibreboard Berhad

How Has Evergreen Fibreboard Berhad Performed Recently?

While the industry has experienced revenue growth lately, Evergreen Fibreboard Berhad's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Evergreen Fibreboard Berhad will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Evergreen Fibreboard Berhad would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.6%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 6.5% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 7.7%, which is not materially different.

With this in consideration, we find it intriguing that Evergreen Fibreboard Berhad's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Evergreen Fibreboard Berhad's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Evergreen Fibreboard Berhad remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Evergreen Fibreboard Berhad, and understanding should be part of your investment process.

If you're unsure about the strength of Evergreen Fibreboard Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Evergreen Fibreboard Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EVERGRN

Evergreen Fibreboard Berhad

Engages in the production and sale of engineered wood-based products.

Reasonable growth potential and fair value.

Market Insights

Community Narratives