- Malaysia

- /

- Paper and Forestry Products

- /

- KLSE:EKSONS

Shareholders Will Likely Find Eksons Corporation Berhad's (KLSE:EKSONS) CEO Compensation Acceptable

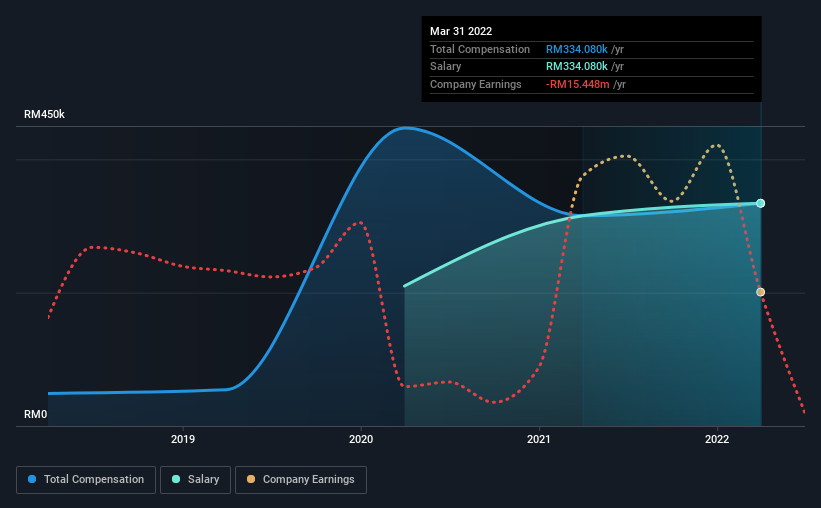

The performance at Eksons Corporation Berhad (KLSE:EKSONS) has been rather lacklustre of late and shareholders may be wondering what CEO Philip Chan is planning to do about this. At the next AGM coming up on 22 September 2022, they can influence managerial decision making through voting on resolutions, including executive remuneration. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for Eksons Corporation Berhad

How Does Total Compensation For Philip Chan Compare With Other Companies In The Industry?

According to our data, Eksons Corporation Berhad has a market capitalization of RM97m, and paid its CEO total annual compensation worth RM334k over the year to March 2022. That's just a smallish increase of 5.9% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth RM334k.

For comparison, other companies in the industry with market capitalizations below RM905m, reported a median total CEO compensation of RM564k. In other words, Eksons Corporation Berhad pays its CEO lower than the industry median.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | RM334k | RM315k | 100% |

| Other | - | - | - |

| Total Compensation | RM334k | RM315k | 100% |

On an industry level, around 83% of total compensation represents salary and 17% is other remuneration. On a company level, Eksons Corporation Berhad prefers to reward its CEO through a salary, opting not to pay Philip Chan through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Eksons Corporation Berhad's Growth

Eksons Corporation Berhad has seen its earnings per share (EPS) increase by 14% a year over the past three years. In the last year, its revenue is up 45%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Eksons Corporation Berhad Been A Good Investment?

With a three year total loss of 22% for the shareholders, Eksons Corporation Berhad would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Eksons Corporation Berhad pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The loss to shareholders over the past three years is certainly concerning. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. A key focus for the board and management will be how to align the share price with fundamentals. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which shouldn't be ignored) in Eksons Corporation Berhad we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Eksons Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EKSONS

Eksons Corporation Berhad

An investment holding company, manufactures and sells tropical thin plywood products in Malaysia and the Middle East.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives