- Malaysia

- /

- Metals and Mining

- /

- KLSE:CORAZA

Why Investors Shouldn't Be Surprised By Coraza Integrated Technology Berhad's (KLSE:CORAZA) 26% Share Price Surge

The Coraza Integrated Technology Berhad (KLSE:CORAZA) share price has done very well over the last month, posting an excellent gain of 26%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

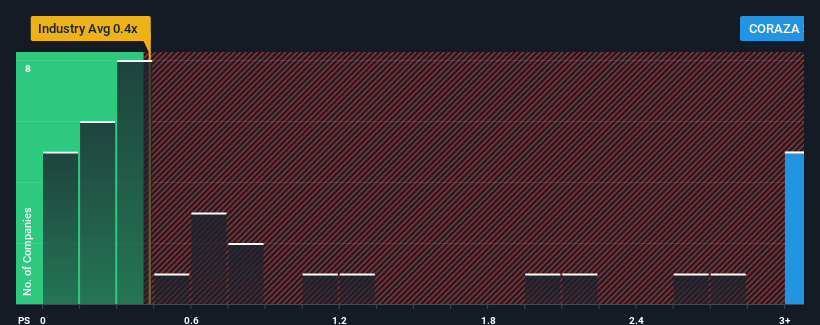

Following the firm bounce in price, when almost half of the companies in Malaysia's Metals and Mining industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider Coraza Integrated Technology Berhad as a stock not worth researching with its 3.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Coraza Integrated Technology Berhad

How Has Coraza Integrated Technology Berhad Performed Recently?

Recent times haven't been great for Coraza Integrated Technology Berhad as its revenue has been falling quicker than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Coraza Integrated Technology Berhad.How Is Coraza Integrated Technology Berhad's Revenue Growth Trending?

Coraza Integrated Technology Berhad's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 44% decrease to the company's top line. As a result, revenue from three years ago have also fallen 3.6% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 30% each year as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 3.2% each year growth forecast for the broader industry.

In light of this, it's understandable that Coraza Integrated Technology Berhad's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Coraza Integrated Technology Berhad's P/S Mean For Investors?

Coraza Integrated Technology Berhad's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Coraza Integrated Technology Berhad maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Metals and Mining industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 3 warning signs we've spotted with Coraza Integrated Technology Berhad.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CORAZA

Coraza Integrated Technology Berhad

An investment holding company, provides integrated engineering services in Malaysia, Singapore, the United States, China, European countries, and rest of Asian countries.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success