- Malaysia

- /

- Basic Materials

- /

- KLSE:CEPCO

Is Concrete Engineering Products Berhad (KLSE:CEPCO) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Concrete Engineering Products Berhad (KLSE:CEPCO) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Concrete Engineering Products Berhad

What Is Concrete Engineering Products Berhad's Debt?

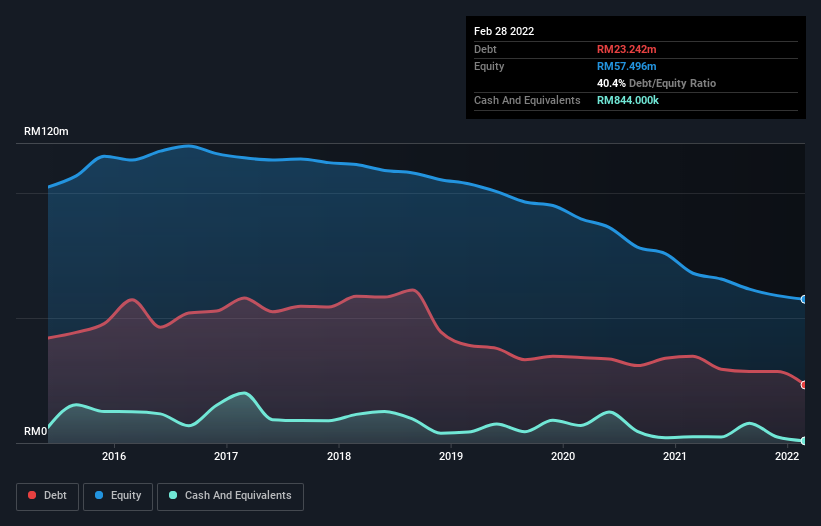

You can click the graphic below for the historical numbers, but it shows that Concrete Engineering Products Berhad had RM23.2m of debt in February 2022, down from RM34.7m, one year before. However, it does have RM844.0k in cash offsetting this, leading to net debt of about RM22.4m.

How Healthy Is Concrete Engineering Products Berhad's Balance Sheet?

We can see from the most recent balance sheet that Concrete Engineering Products Berhad had liabilities of RM82.5m falling due within a year, and liabilities of RM745.0k due beyond that. Offsetting this, it had RM844.0k in cash and RM29.3m in receivables that were due within 12 months. So its liabilities total RM53.0m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of RM64.2m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. There's no doubt that we learn most about debt from the balance sheet. But it is Concrete Engineering Products Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Concrete Engineering Products Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 96%, to RM119m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Despite the top line growth, Concrete Engineering Products Berhad still had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping RM9.8m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. For example, we would not want to see a repeat of last year's loss of RM10m. In the meantime, we consider the stock very risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Concrete Engineering Products Berhad (1 makes us a bit uncomfortable) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CEPCO

Concrete Engineering Products Berhad

Manufactures and distributes prestressed spun concrete piles and poles in Malaysia.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026