Subdued Growth No Barrier To Bright Packaging Industry Berhad's (KLSE:BRIGHT) Price

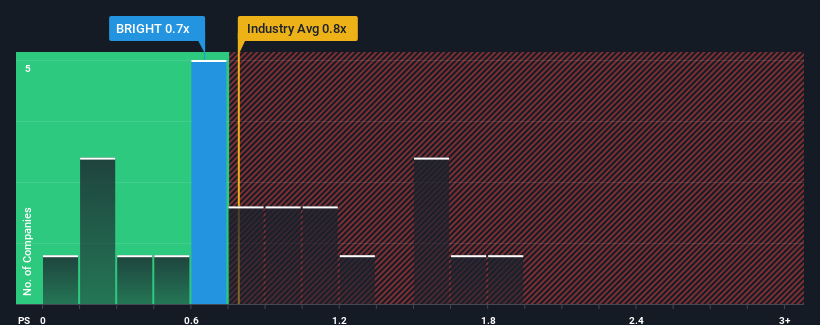

It's not a stretch to say that Bright Packaging Industry Berhad's (KLSE:BRIGHT) price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" for companies in the Packaging industry in Malaysia, where the median P/S ratio is around 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Bright Packaging Industry Berhad

What Does Bright Packaging Industry Berhad's Recent Performance Look Like?

Recent times have been quite advantageous for Bright Packaging Industry Berhad as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bright Packaging Industry Berhad's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Bright Packaging Industry Berhad?

In order to justify its P/S ratio, Bright Packaging Industry Berhad would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 45%. As a result, it also grew revenue by 16% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 9.2% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Bright Packaging Industry Berhad's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From Bright Packaging Industry Berhad's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Bright Packaging Industry Berhad's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Before you settle on your opinion, we've discovered 3 warning signs for Bright Packaging Industry Berhad (2 are a bit unpleasant!) that you should be aware of.

If you're unsure about the strength of Bright Packaging Industry Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bright Packaging Industry Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BRIGHT

Bright Packaging Industry Berhad

An investment holding company, manufactures and sells aluminum foil packaging materials in Malaysia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives