What Did Batu Kawan Berhad's (KLSE:BKAWAN) CEO Take Home Last Year?

Hau-Hian Lee has been the CEO of Batu Kawan Berhad (KLSE:BKAWAN) since 1993, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Batu Kawan Berhad

How Does Total Compensation For Hau-Hian Lee Compare With Other Companies In The Industry?

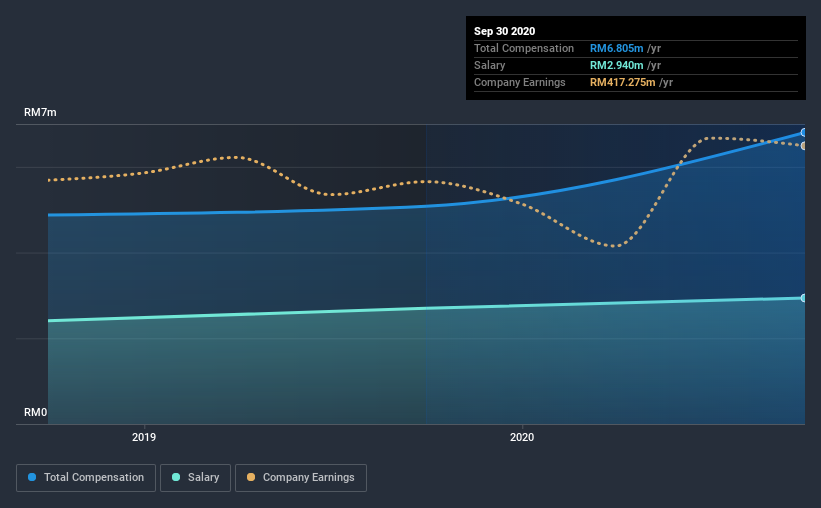

According to our data, Batu Kawan Berhad has a market capitalization of RM7.1b, and paid its CEO total annual compensation worth RM6.8m over the year to September 2020. We note that's an increase of 34% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at RM2.9m.

On comparing similar companies from the same industry with market caps ranging from RM4.0b to RM13b, we found that the median CEO total compensation was RM2.2m. Hence, we can conclude that Hau-Hian Lee is remunerated higher than the industry median. Moreover, Hau-Hian Lee also holds RM28m worth of Batu Kawan Berhad stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM2.9m | RM2.7m | 43% |

| Other | RM3.9m | RM2.4m | 57% |

| Total Compensation | RM6.8m | RM5.1m | 100% |

Speaking on an industry level, nearly 59% of total compensation represents salary, while the remainder of 41% is other remuneration. Batu Kawan Berhad sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Batu Kawan Berhad's Growth Numbers

Over the last three years, Batu Kawan Berhad has shrunk its earnings per share by 10% per year. Revenue was pretty flat on last year.

Few shareholders would be pleased to read that EPS have declined. And the flat revenue is seriously uninspiring. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Batu Kawan Berhad Been A Good Investment?

Batu Kawan Berhad has not done too badly by shareholders, with a total return of 0.4%, over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As we touched on above, Batu Kawan Berhad is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Unfortunately, EPS has not grown in three years, failing to impress us. While shareholder returns are acceptable, they don't delight. So we think more research is needed, but we don't think the CEO is underpaid.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 1 which is a bit unpleasant) in Batu Kawan Berhad we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Batu Kawan Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Batu Kawan Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:BKAWAN

Batu Kawan Berhad

An investment holding company, cultivates and processes palm and rubber products in Malaysia, the Far East, the Middle East, South East Asia, Southern Asia, Europe, North and South America, Australia, Africa, and internationally.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives