- Malaysia

- /

- Metals and Mining

- /

- KLSE:AUMAS

Bahvest Resources Berhad's (KLSE:BAHVEST) 27% Jump Shows Its Popularity With Investors

Bahvest Resources Berhad (KLSE:BAHVEST) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 74% in the last year.

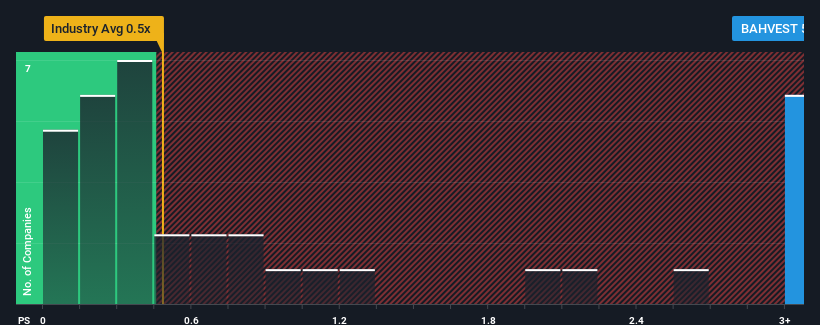

Since its price has surged higher, given around half the companies in Malaysia's Metals and Mining industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider Bahvest Resources Berhad as a stock to avoid entirely with its 5.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Bahvest Resources Berhad

How Bahvest Resources Berhad Has Been Performing

For instance, Bahvest Resources Berhad's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bahvest Resources Berhad's earnings, revenue and cash flow.How Is Bahvest Resources Berhad's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Bahvest Resources Berhad's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 44% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 9.5%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Bahvest Resources Berhad is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Bahvest Resources Berhad's P/S Mean For Investors?

The strong share price surge has lead to Bahvest Resources Berhad's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Bahvest Resources Berhad maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Bahvest Resources Berhad that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AUMAS

AuMas Resources Berhad

An investment holding company, engages in gold mining business in Malaysia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026