- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:WAVEFRNT

Do Insiders Own Lots Of Shares In ATA IMS Berhad (KLSE:ATAIMS)?

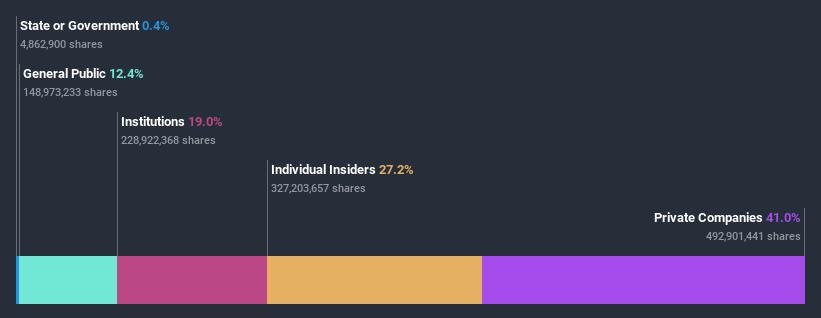

A look at the shareholders of ATA IMS Berhad (KLSE:ATAIMS) can tell us which group is most powerful. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

With a market capitalization of RM3.0b, ATA IMS Berhad is a small cap stock, so it might not be well known by many institutional investors. Our analysis of the ownership of the company, below, shows that institutional investors have bought into the company. We can zoom in on the different ownership groups, to learn more about ATA IMS Berhad.

See our latest analysis for ATA IMS Berhad

What Does The Institutional Ownership Tell Us About ATA IMS Berhad?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

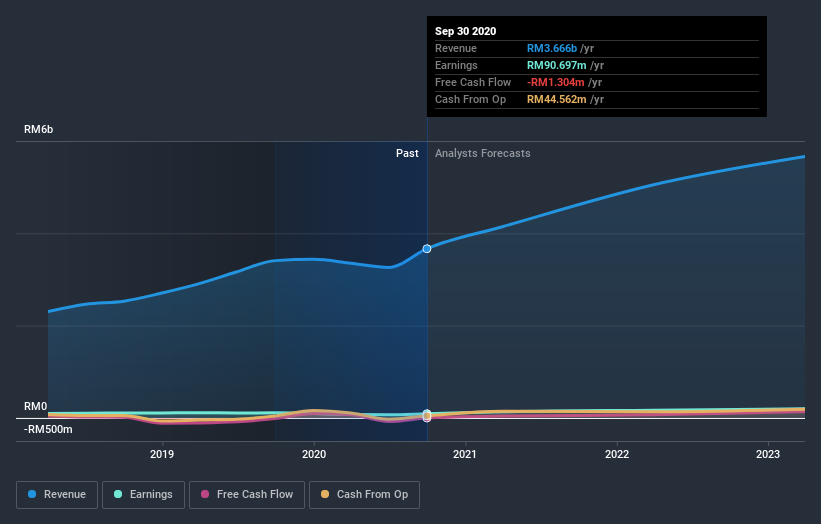

ATA IMS Berhad already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at ATA IMS Berhad's earnings history below. Of course, the future is what really matters.

We note that hedge funds don't have a meaningful investment in ATA IMS Berhad. The company's largest shareholder is Oregon Technology Sdn. Bhd., with ownership of 34%. Meanwhile, the second and third largest shareholders, hold 26% and 7.2%, of the shares outstanding, respectively. Chiu-Wan Fong, who is the second-largest shareholder, also happens to hold the title of Chief Executive Officer.

To make our study more interesting, we found that the top 2 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of ATA IMS Berhad

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems insiders own a significant proportion of ATA IMS Berhad. Insiders have a RM808m stake in this RM3.0b business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

With a 12% ownership, the general public have some degree of sway over ATA IMS Berhad. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

It seems that Private Companies own 41%, of the ATA IMS Berhad stock. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that ATA IMS Berhad is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade ATA IMS Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WaveFront Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:WAVEFRNT

WaveFront Berhad

An investment holding company, provides electronics manufacturing services in Malaysia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026