- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:ATAIMS

ATA IMS Berhad's (KLSE:ATAIMS) Price In Tune With Earnings

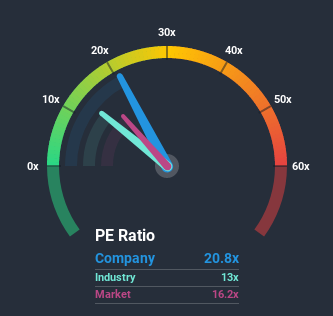

With a price-to-earnings (or "P/E") ratio of 20.8x ATA IMS Berhad (KLSE:ATAIMS) may be sending bearish signals at the moment, given that almost half of all companies in Malaysia have P/E ratios under 16x and even P/E's lower than 9x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

ATA IMS Berhad has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for ATA IMS Berhad

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like ATA IMS Berhad's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 34%. As a result, earnings from three years ago have also fallen 15% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 23% per annum during the coming three years according to the five analysts following the company. With the market only predicted to deliver 9.8% per year, the company is positioned for a stronger earnings result.

With this information, we can see why ATA IMS Berhad is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that ATA IMS Berhad maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for ATA IMS Berhad you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

When trading ATA IMS Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:ATAIMS

ATA IMS Berhad

An investment holding company, provides electronics manufacturing services in Malaysia.

Adequate balance sheet very low.