- Malaysia

- /

- Metals and Mining

- /

- KLSE:ALCOM

Alcom Group Berhad (KLSE:ALCOM) Will Pay A Smaller Dividend Than Last Year

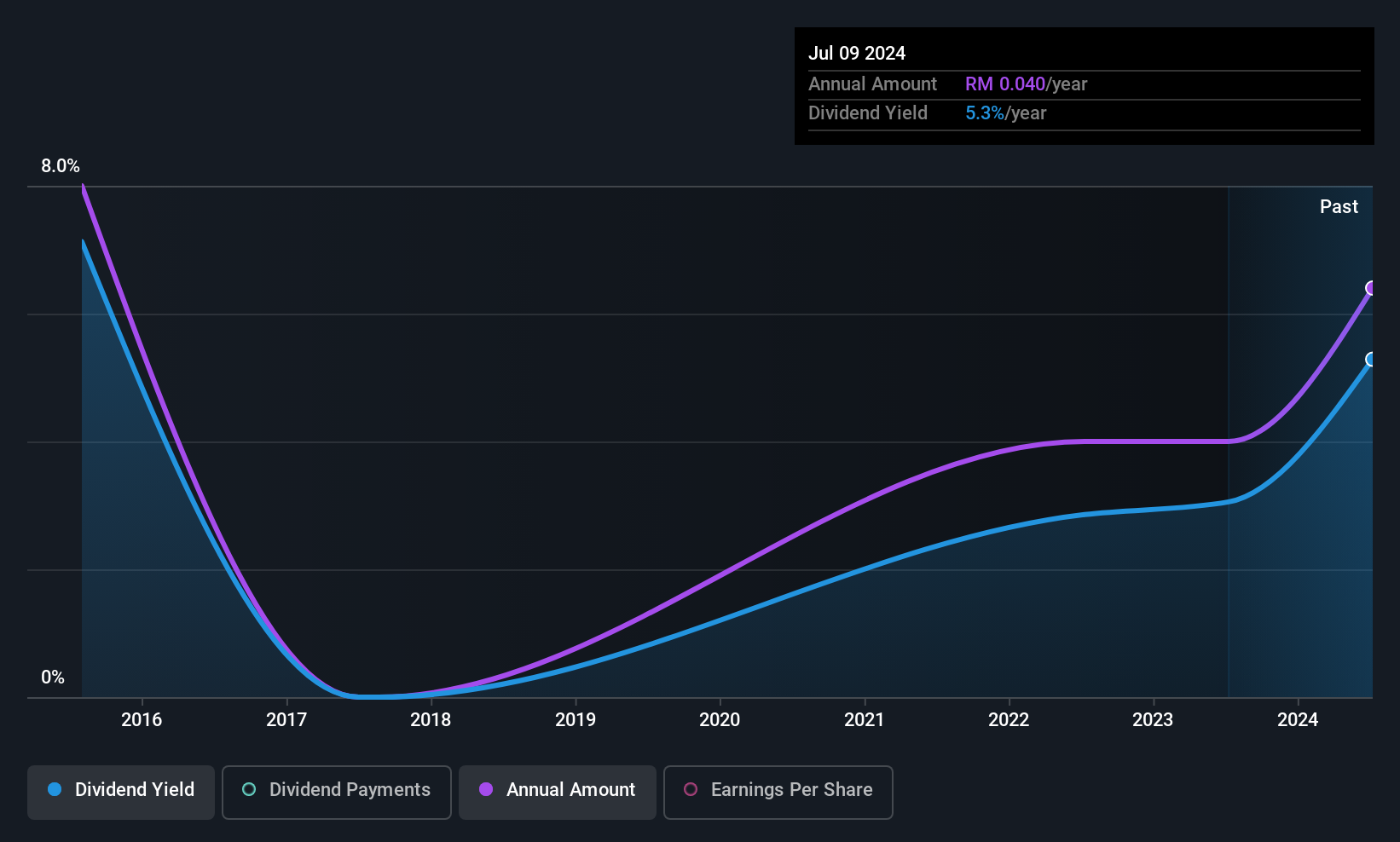

Alcom Group Berhad (KLSE:ALCOM) has announced that on 25th of July, it will be paying a dividend ofMYR0.03, which a reduction from last year's comparable dividend. The yield is still above the industry average at 3.9%.

Alcom Group Berhad's Distributions May Be Difficult To Sustain

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Even in the absence of profits, Alcom Group Berhad is paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Over the next year, EPS could expand by 3.1% if recent trends continue. The company seems to be going down the right path, but it will probably take a little bit longer than a year to cross over into profitability. Unless this can be done in short order, the dividend might be difficult to sustain.

View our latest analysis for Alcom Group Berhad

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from an annual total of MYR0.05 in 2015 to the most recent total annual payment of MYR0.03. The dividend has shrunk at around 5.0% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth May Be Hard To Achieve

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings have grown at around 3.1% a year for the past five years, which isn't massive but still better than seeing them shrink. With no profits, we don't think Alcom Group Berhad has much potential to grow the dividend in the future.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments are bit high to be considered sustainable, and the track record isn't the best. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 4 warning signs for Alcom Group Berhad you should be aware of, and 2 of them are potentially serious. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ALCOM

Alcom Group Berhad

An investment holding company, manufactures and trades aluminum sheet and coils products in Malaysia, the United States, Thailand, India, rest of Asia, Europe, the Middle East, and internationally.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026