- Malaysia

- /

- Hospitality

- /

- KLSE:MPHBCAP

MPHB Capital Berhad's (KLSE:MPHBCAP) Business Is Trailing The Market But Its Shares Aren't

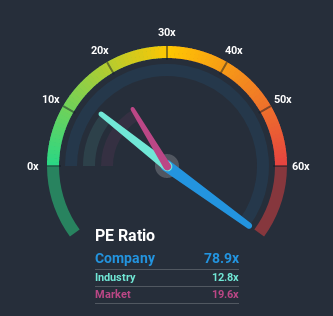

When close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 19x, you may consider MPHB Capital Berhad (KLSE:MPHBCAP) as a stock to avoid entirely with its 78.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that MPHB Capital Berhad's financial performance has been poor lately as it's earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for MPHB Capital Berhad

How Is MPHB Capital Berhad's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like MPHB Capital Berhad's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 75%. As a result, earnings from three years ago have also fallen 87% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 21% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that MPHB Capital Berhad is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that MPHB Capital Berhad currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with MPHB Capital Berhad (including 1 which is significant).

Of course, you might also be able to find a better stock than MPHB Capital Berhad. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

When trading MPHB Capital Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:MPHBCAP

MPHB Capital Berhad

An investment holding company, operates hotel in Malaysia.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives