Subdued Growth No Barrier To LPI Capital Bhd's (KLSE:LPI) Price

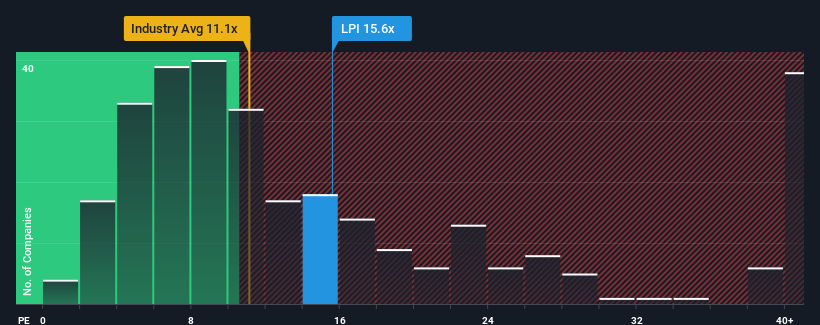

It's not a stretch to say that LPI Capital Bhd's (KLSE:LPI) price-to-earnings (or "P/E") ratio of 15.6x right now seems quite "middle-of-the-road" compared to the market in Malaysia, where the median P/E ratio is around 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, LPI Capital Bhd has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for LPI Capital Bhd

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like LPI Capital Bhd's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 31%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 5.5% per annum during the coming three years according to the four analysts following the company. That's shaping up to be materially lower than the 14% per annum growth forecast for the broader market.

In light of this, it's curious that LPI Capital Bhd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of LPI Capital Bhd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for LPI Capital Bhd you should be aware of, and 1 of them shouldn't be ignored.

You might be able to find a better investment than LPI Capital Bhd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LPI

LPI Capital Bhd

An investment holding company, engages in the underwriting of general insurance products for personal and business needs in Malaysia, Singapore, and Cambodia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives