- Malaysia

- /

- Personal Products

- /

- KLSE:NOVA

Nova Wellness Group Berhad's (KLSE:NOVA) Shareholders Will Receive A Bigger Dividend Than Last Year

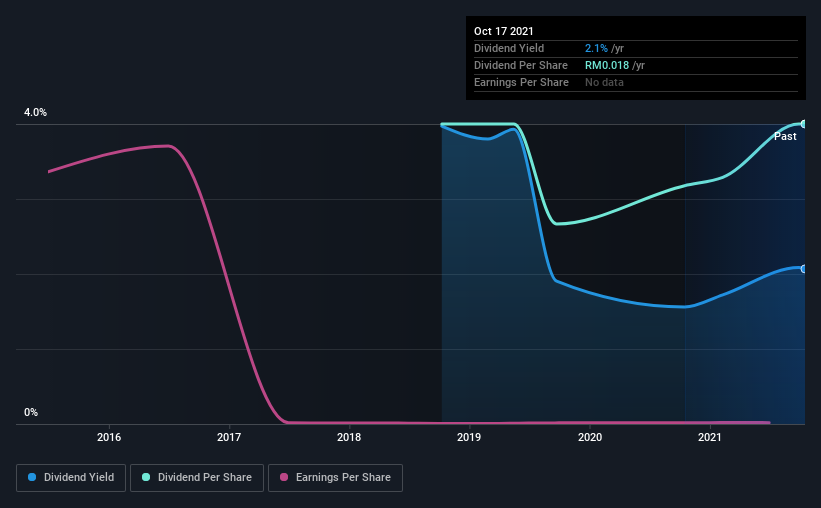

The board of Nova Wellness Group Berhad (KLSE:NOVA) has announced that it will be increasing its dividend on the 8th of December to RM0.012. This will take the dividend yield from 2.1% to 3.4%, providing a nice boost to shareholder returns.

View our latest analysis for Nova Wellness Group Berhad

Nova Wellness Group Berhad's Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Nova Wellness Group Berhad was paying only paying out a fraction of earnings, but the payment was a massive 235% of cash flows. A cash payout ratio this high could put the dividend under pressure and force the company to reduce it in the future if it were to run into tough times.

Looking forward, earnings per share is forecast to rise by 41.9% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 11% by next year, which is in a pretty sustainable range.

Nova Wellness Group Berhad's Dividend Has Lacked Consistency

Even in its short history, we have seen the dividend cut. The payments haven't really changed that much since 3 years ago. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Nova Wellness Group Berhad's earnings per share has shrunk at 65% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Nova Wellness Group Berhad's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Nova Wellness Group Berhad's payments are rock solid. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Nova Wellness Group Berhad that investors need to be conscious of moving forward. We have also put together a list of global stocks with a solid dividend.

Valuation is complex, but we're here to simplify it.

Discover if Nova Wellness Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:NOVA

Nova Wellness Group Berhad

Develops, produces, and sells nutraceutical and skincare products in Malaysia and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives