- Malaysia

- /

- Personal Products

- /

- KLSE:ENGKAH

Did You Manage To Avoid Eng Kah Corporation Berhad's (KLSE:ENGKAH) Painful 56% Share Price Drop?

The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Eng Kah Corporation Berhad (KLSE:ENGKAH), since the last five years saw the share price fall 56%.

Check out our latest analysis for Eng Kah Corporation Berhad

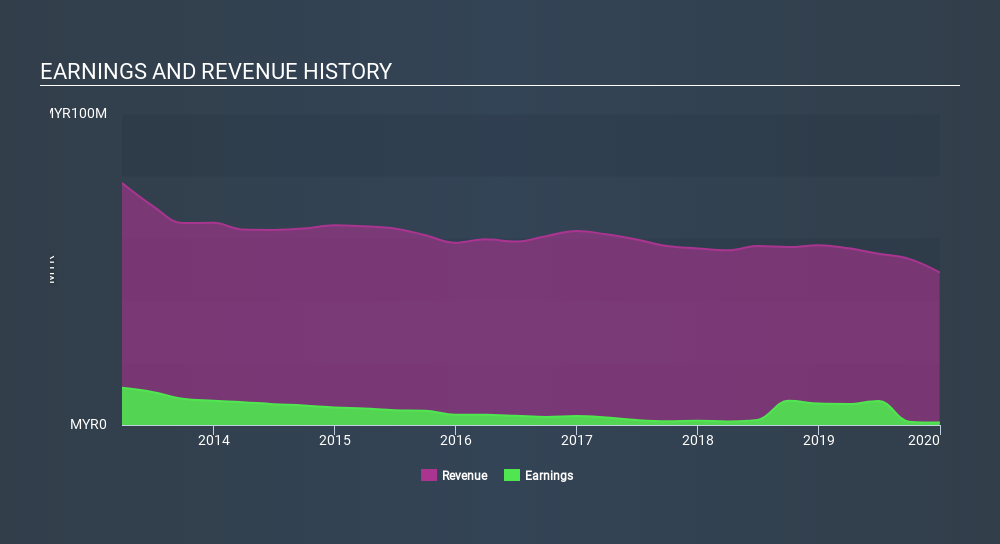

We don't think that Eng Kah Corporation Berhad's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last five years Eng Kah Corporation Berhad saw its revenue shrink by 3.5% per year. That's not what investors generally want to see. The share price decline of 15% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Eng Kah Corporation Berhad's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Eng Kah Corporation Berhad, it has a TSR of -48% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While it's certainly disappointing to see that Eng Kah Corporation Berhad shares lost 6.9% throughout the year, that wasn't as bad as the market loss of 8.4%. Of far more concern is the 12% p.a. loss served to shareholders over the last five years. While the losses are slowing we doubt many shareholders are happy with the stock. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Eng Kah Corporation Berhad (including 1 which is is concerning) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:ENGKAH

Eng Kah Corporation Berhad

An investment holding company, engages in the manufacture and sale of cosmetics, skin care, perfume, household, toiletries, and personal care products in Malaysia, the Asia Pacific, the United States, and Australia.

Flawless balance sheet low.

Market Insights

Community Narratives