- Malaysia

- /

- Personal Products

- /

- KLSE:BIOHLDG

Is Bioalpha Holdings Berhad's (KLSE:BIOHLDG) Recent Stock Performance Influenced By Its Fundamentals In Any Way?

Bioalpha Holdings Berhad (KLSE:BIOHLDG) has had a great run on the share market with its stock up by a significant 138% over the last month. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Bioalpha Holdings Berhad's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Bioalpha Holdings Berhad

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Bioalpha Holdings Berhad is:

1.1% = RM1.7m ÷ RM159m (Based on the trailing twelve months to March 2020).

The 'return' is the yearly profit. One way to conceptualize this is that for each MYR1 of shareholders' capital it has, the company made MYR0.01 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Bioalpha Holdings Berhad's Earnings Growth And 1.1% ROE

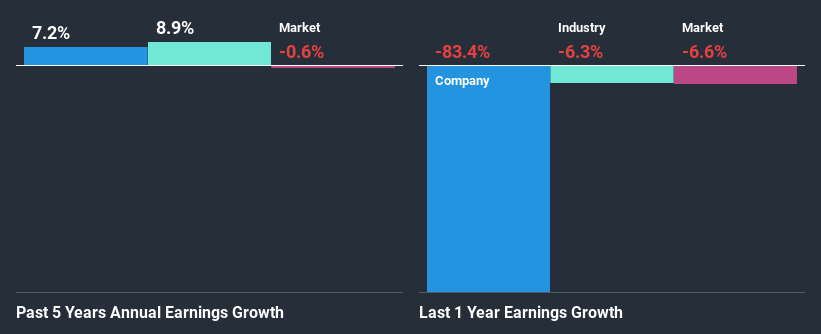

It is hard to argue that Bioalpha Holdings Berhad's ROE is much good in and of itself. Even when compared to the industry average of 11%, the ROE figure is pretty disappointing. However, the moderate 7.2% net income growth seen by Bioalpha Holdings Berhad over the past five years is definitely a positive. Therefore, the growth in earnings could probably have been caused by other variables. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared Bioalpha Holdings Berhad's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 9.7% in the same period, which is a bit concerning.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Bioalpha Holdings Berhad is trading on a high P/E or a low P/E, relative to its industry.

Is Bioalpha Holdings Berhad Efficiently Re-investing Its Profits?

Bioalpha Holdings Berhad's three-year median payout ratio to shareholders is 7.8% (implying that it retains 92% of its income), which is on the lower side, so it seems like the management is reinvesting profits heavily to grow its business.

Conclusion

In total, it does look like Bioalpha Holdings Berhad has some positive aspects to its business. That is, a decent growth in earnings backed by a high rate of reinvestment. However, we do feel that that earnings growth could have been higher if the business were to improve on the low ROE rate. Especially given how the company is reinvesting a huge chunk of its profits. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

When trading Bioalpha Holdings Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bioalpha Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:BIOHLDG

Bioalpha Holdings Berhad

An investment holding company, manufactures and sells health supplement products in Malaysia, China, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026