- Malaysia

- /

- Healthcare Services

- /

- KLSE:PHARMA

Bullish: Analysts Just Made A Massive Upgrade To Their Pharmaniaga Berhad (KLSE:PHARMA) Forecasts

Pharmaniaga Berhad (KLSE:PHARMA) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance. The market seems to be pricing in some improvement in the business too, with the stock up 6.3% over the past week, closing at RM0.84. It will be interesting to see if this latest upgrade is enough to kickstart further buying interest in the stock.

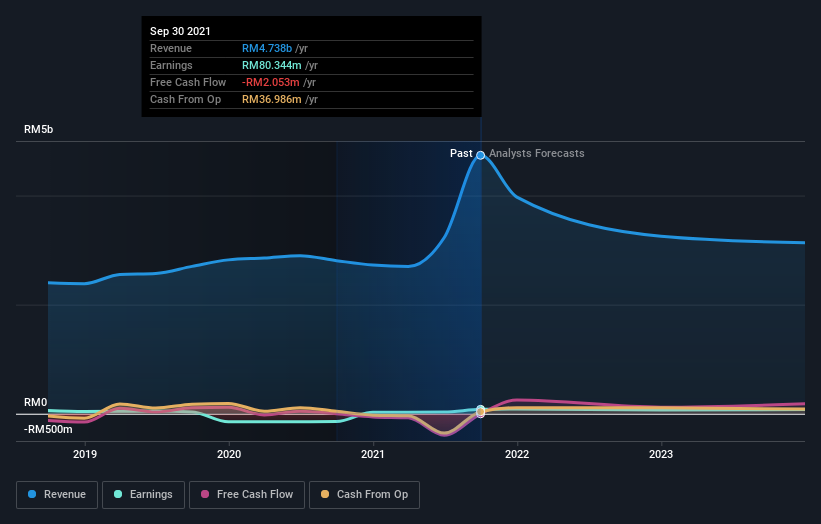

After the upgrade, the consensus from Pharmaniaga Berhad's five analysts is for revenues of RM4.0b in 2021, which would reflect a chunky 16% decline in sales compared to the last year of performance. Statutory earnings per share are presumed to increase 6.0% to RM0.065. Prior to this update, the analysts had been forecasting revenues of RM3.2b and earnings per share (EPS) of RM0.049 in 2021. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

View our latest analysis for Pharmaniaga Berhad

It will come as no surprise to learn that the analysts have increased their price target for Pharmaniaga Berhad 5.5% to RM0.92 on the back of these upgrades. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Pharmaniaga Berhad, with the most bullish analyst valuing it at RM1.06 and the most bearish at RM0.63 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Pharmaniaga Berhad shareholders.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Pharmaniaga Berhad's past performance and to peers in the same industry. We would highlight that sales are expected to reverse, with a forecast 16% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 10% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 7.9% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Pharmaniaga Berhad is expected to lag the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Pharmaniaga Berhad could be worth investigating further.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple Pharmaniaga Berhad analysts - going out to 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:PHARMA

Pharmaniaga Berhad

An investment holding company, operates as an integrated healthcare service provider in Malaysia, Indonesia, and internationally.

Undervalued with acceptable track record.

Market Insights

Community Narratives