- Malaysia

- /

- Medical Equipment

- /

- KLSE:LKL

What Type Of Shareholders Own The Most Number of LKL International Berhad (KLSE:LKL) Shares?

If you want to know who really controls LKL International Berhad (KLSE:LKL), then you'll have to look at the makeup of its share registry. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

LKL International Berhad is not a large company by global standards. It has a market capitalization of RM476m, which means it wouldn't have the attention of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions are not on the share registry. We can zoom in on the different ownership groups, to learn more about LKL International Berhad.

See our latest analysis for LKL International Berhad

What Does The Lack Of Institutional Ownership Tell Us About LKL International Berhad?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

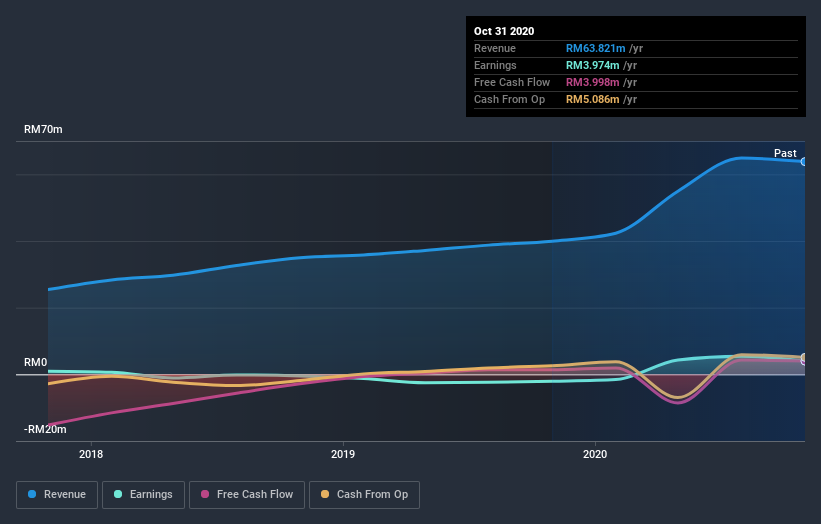

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. LKL International Berhad's earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Hedge funds don't have many shares in LKL International Berhad. From our data, we infer that the largest shareholder is Kon Lim (who also holds the title of Top Key Executive) with 20% of shares outstanding. Its usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider play the role of a key stakeholder. For context, the second largest shareholder holds about 16% of the shares outstanding, followed by an ownership of 6.9% by the third-largest shareholder. Interestingly, the third-largest shareholder, Pak Lim is also a Member of the Board of Directors, again, indicating strong insider ownership amongst the company's top shareholders.

To make our study more interesting, we found that the top 5 shareholders control more than half of the company which implies that this group has considerable sway over the company's decision-making.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of LKL International Berhad

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems that insiders own more than half the LKL International Berhad stock. This gives them a lot of power. Given it has a market cap of RM476m, that means they have RM246m worth of shares. Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 48% ownership, the general public have some degree of sway over LKL International Berhad. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Be aware that LKL International Berhad is showing 2 warning signs in our investment analysis , and 1 of those is concerning...

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade LKL International Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:LKL

LKL International Berhad

An investment holding company, manufactures, sells, and trades in medical and healthcare beds, medical peripherals, and related accessories under the LKL brand in Malaysia, Africa, Europe, the Middle East, and the rest of Asia.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion