- Malaysia

- /

- Medical Equipment

- /

- KLSE:HARTA

What You Can Learn From Hartalega Holdings Berhad's (KLSE:HARTA) P/S After Its 26% Share Price Crash

The Hartalega Holdings Berhad (KLSE:HARTA) share price has fared very poorly over the last month, falling by a substantial 26%. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

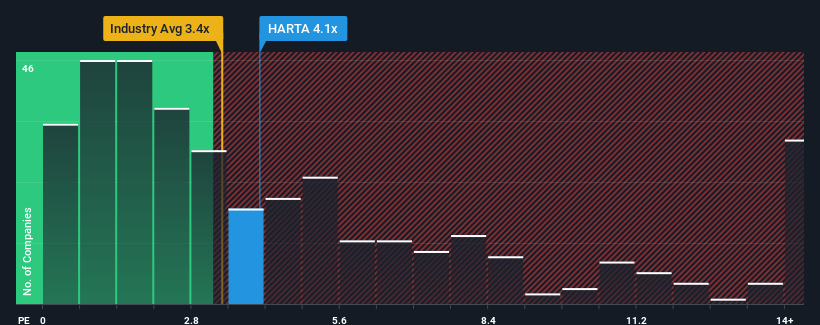

In spite of the heavy fall in price, given close to half the companies operating in Malaysia's Medical Equipment industry have price-to-sales ratios (or "P/S") below 3.2x, you may still consider Hartalega Holdings Berhad as a stock to potentially avoid with its 4.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Hartalega Holdings Berhad

What Does Hartalega Holdings Berhad's Recent Performance Look Like?

Recent revenue growth for Hartalega Holdings Berhad has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hartalega Holdings Berhad.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Hartalega Holdings Berhad's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 79% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 36% during the coming year according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 20%, which is noticeably less attractive.

In light of this, it's understandable that Hartalega Holdings Berhad's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Despite the recent share price weakness, Hartalega Holdings Berhad's P/S remains higher than most other companies in the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Hartalega Holdings Berhad's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Hartalega Holdings Berhad has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Hartalega Holdings Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hartalega Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HARTA

Hartalega Holdings Berhad

An investment holding company, engages in the manufacture, retail, and wholesale of latex and nitrile gloves in Malaysia, North America, Europe, Asia, Australia, and the Middle East.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives