- Malaysia

- /

- Medical Equipment

- /

- KLSE:HARTA

I Ran A Stock Scan For Earnings Growth And Hartalega Holdings Berhad (KLSE:HARTA) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Hartalega Holdings Berhad (KLSE:HARTA). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Hartalega Holdings Berhad

How Fast Is Hartalega Holdings Berhad Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that Hartalega Holdings Berhad grew its EPS from RM0.29 to RM1.55, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

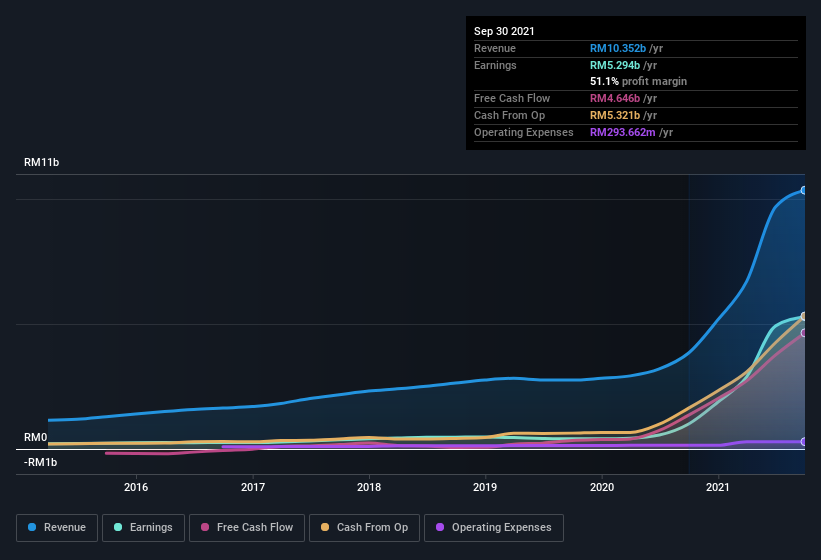

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Hartalega Holdings Berhad shareholders can take confidence from the fact that EBIT margins are up from 33% to 67%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Hartalega Holdings Berhad's future profits.

Are Hartalega Holdings Berhad Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Hartalega Holdings Berhad insiders own a meaningful share of the business. In fact, they own 46% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. And their holding is extremely valuable at the current share price, totalling RM9.0b. That means they have plenty of their own capital riding on the performance of the business!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. For companies with market capitalizations between RM8.4b and RM27b, like Hartalega Holdings Berhad, the median CEO pay is around RM4.4m.

The Hartalega Holdings Berhad CEO received total compensation of only RM144k in the year to . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Hartalega Holdings Berhad To Your Watchlist?

Hartalega Holdings Berhad's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Hartalega Holdings Berhad certainly ticks a few of my boxes, so I think it's probably well worth further consideration. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Hartalega Holdings Berhad that you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hartalega Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HARTA

Hartalega Holdings Berhad

An investment holding company, engages in the manufacture, retail, and wholesale of latex and nitrile gloves in Malaysia, North America, Europe, Asia, Australia, the Middle East, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives