Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Adventa Berhad (KLSE:ADVENTA) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Adventa Berhad

What Is Adventa Berhad's Net Debt?

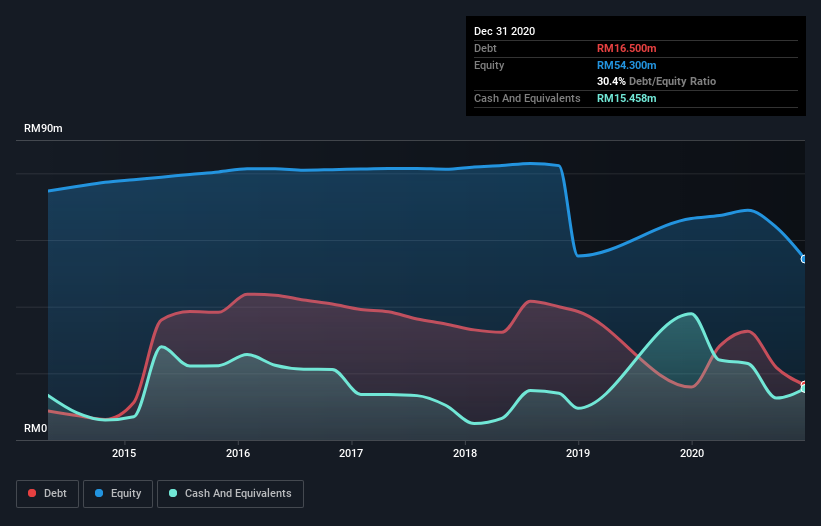

As you can see below, Adventa Berhad had RM16.1m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have RM15.5m in cash offsetting this, leading to net debt of about RM672.0k.

How Strong Is Adventa Berhad's Balance Sheet?

According to the balance sheet data, Adventa Berhad had liabilities of RM22.9m due within 12 months, but no longer term liabilities. Offsetting these obligations, it had cash of RM15.5m as well as receivables valued at RM17.2m due within 12 months. So it actually has RM9.75m more liquid assets than total liabilities.

This short term liquidity is a sign that Adventa Berhad could probably pay off its debt with ease, as its balance sheet is far from stretched. But either way, Adventa Berhad has virtually no net debt, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Adventa Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Adventa Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 187%, to RM87m. So its pretty obvious shareholders are hoping for more growth!

Caveat Emptor

Despite the top line growth, Adventa Berhad still had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost RM11m at the EBIT level. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. But we'd want to see some positive free cashflow before spending much time on trying to understand the stock. Having said that the rate of revenue growth will likely impress the market, greatly facilitating any potential capital raising, if required. Despite that strong positive, this one could still be considered a bit too risky, by some. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Adventa Berhad (1 can't be ignored) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Adventa Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ADVENTA

Adventa Berhad

An investment holding company, engages in the supply of healthcare and related products and services to hospitals, healthcare centers, and pharmacies in Malaysia, Sri Lanka, and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026