TSH Resources Berhad's (KLSE:TSH) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

TSH Resources Berhad (KLSE:TSH) has had a rough month with its share price down 12%. However, the company's fundamentals look pretty decent, and long-term financials are usually aligned with future market price movements. Specifically, we decided to study TSH Resources Berhad's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for TSH Resources Berhad

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for TSH Resources Berhad is:

4.5% = RM68m ÷ RM1.5b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. That means that for every MYR1 worth of shareholders' equity, the company generated MYR0.04 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

TSH Resources Berhad's Earnings Growth And 4.5% ROE

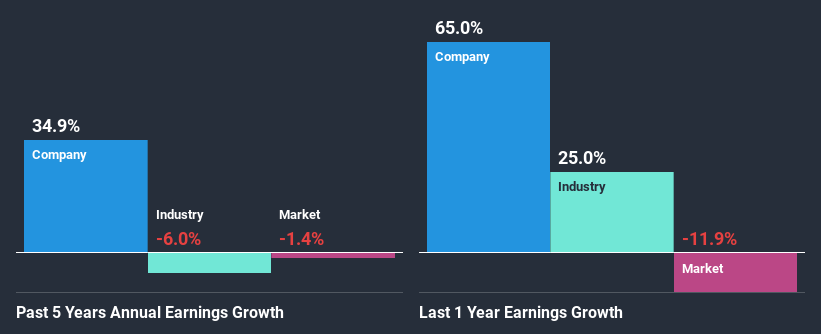

It is hard to argue that TSH Resources Berhad's ROE is much good in and of itself. Not just that, even compared to the industry average of 6.9%, the company's ROE is entirely unremarkable. Despite this, surprisingly, TSH Resources Berhad saw an exceptional 35% net income growth over the past five years. Therefore, there could be other reasons behind this growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that the growth figure reported by TSH Resources Berhad compares quite favourably to the industry average, which shows a decline of 6.0% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Is TSH Resources Berhad fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is TSH Resources Berhad Making Efficient Use Of Its Profits?

TSH Resources Berhad has a three-year median payout ratio of 38% (where it is retaining 62% of its income) which is not too low or not too high. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like TSH Resources Berhad is reinvesting its earnings efficiently.

Besides, TSH Resources Berhad has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 29% over the next three years. As a result, the expected drop in TSH Resources Berhad's payout ratio explains the anticipated rise in the company's future ROE to 5.8%, over the same period.

Summary

Overall, we feel that TSH Resources Berhad certainly does have some positive factors to consider. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you’re looking to trade TSH Resources Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TSH Resources Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:TSH

TSH Resources Berhad

An investment holding company, primarily engages in oil palm cultivation and processing, and forest plantation activities in Malaysia, Indonesia, Southwest Pacific, the United States, and internationally.

Flawless balance sheet average dividend payer.