Sime Darby Plantation Berhad (KLSE:SIMEPLT) investors are sitting on a loss of 23% if they invested a year ago

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Sime Darby Plantation Berhad (KLSE:SIMEPLT) share price slid 25% over twelve months. That's well below the market decline of 3.1%. At least the damage isn't so bad if you look at the last three years, since the stock is down 16% in that time. Even worse, it's down 8.0% in about a month, which isn't fun at all. We do note, however, that the broader market is down 5.0% in that period, and this may have weighed on the share price.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Sime Darby Plantation Berhad

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Sime Darby Plantation Berhad share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

We don't see any weakness in the Sime Darby Plantation Berhad's dividend so the steady payout can't really explain the share price drop. The revenue trend doesn't seem to explain why the share price is down. Of course, it could simply be that it simply fell short of the market consensus expectations.

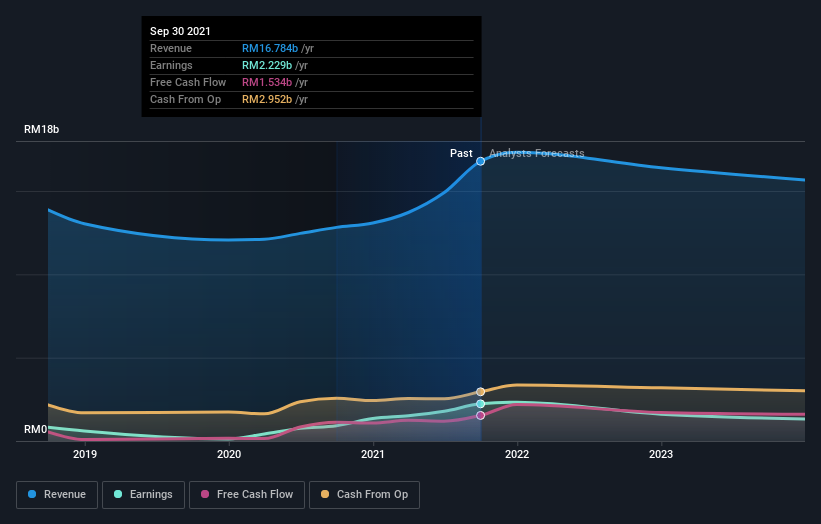

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Sime Darby Plantation Berhad is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Sime Darby Plantation Berhad in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Sime Darby Plantation Berhad, it has a TSR of -23% for the last 1 year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

The last twelve months weren't great for Sime Darby Plantation Berhad shares, which performed worse than the market, costing holders 23%, including dividends. The market shed around 3.1%, no doubt weighing on the stock price. Shareholders have lost 4% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Sime Darby Plantation Berhad better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Sime Darby Plantation Berhad (of which 1 shouldn't be ignored!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SDG

SD Guthrie Berhad

Operates as an integrated plantations company in Malaysia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.