Why Sin Heng Chan (Malaya) Berhad's (KLSE:SHCHAN) Shaky Earnings Are Just The Beginning Of Its Problems

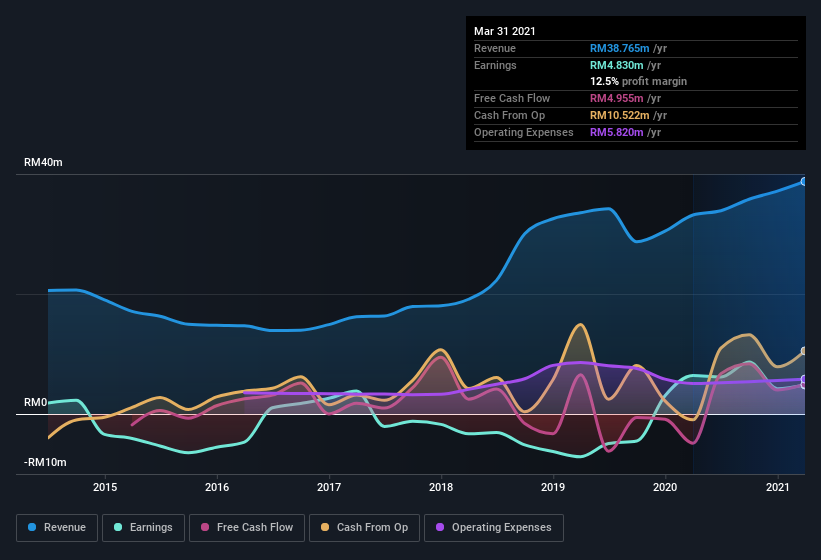

Sin Heng Chan (Malaya) Berhad's (KLSE:SHCHAN) recent weak earnings report didn't cause a big stock movement. However, we believe that investors should be aware of some underlying factors which may be of concern.

View our latest analysis for Sin Heng Chan (Malaya) Berhad

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Sin Heng Chan (Malaya) Berhad issued 83% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Sin Heng Chan (Malaya) Berhad's historical EPS growth by clicking on this link.

How Is Dilution Impacting Sin Heng Chan (Malaya) Berhad's Earnings Per Share? (EPS)

Sin Heng Chan (Malaya) Berhad was losing money three years ago. And even focusing only on the last twelve months, we see profit is down 25%. Sadly, earnings per share fell further, down a full 25% in that time. So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, if Sin Heng Chan (Malaya) Berhad's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Sin Heng Chan (Malaya) Berhad.

Our Take On Sin Heng Chan (Malaya) Berhad's Profit Performance

Sin Heng Chan (Malaya) Berhad issued shares during the year, and that means its EPS performance lags its net income growth. As a result, we think it may well be the case that Sin Heng Chan (Malaya) Berhad's underlying earnings power is lower than its statutory profit. Sadly, its EPS was down over the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Be aware that Sin Heng Chan (Malaya) Berhad is showing 5 warning signs in our investment analysis and 2 of those are significant...

This note has only looked at a single factor that sheds light on the nature of Sin Heng Chan (Malaya) Berhad's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SHCHAN

Sin Heng Chan (Malaya) Berhad

An investment holding company, operates oil palm plantations in Malaysia.

Slight risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.