Additional Considerations Required While Assessing Sungei Bagan Rubber Company (Malaya) Berhad's (KLSE:SBAGAN) Strong Earnings

Sungei Bagan Rubber Company (Malaya) Berhad (KLSE:SBAGAN) just reported some strong earnings, and the market reacted accordingly with a healthy uplift in the share price. However, we think that shareholders may be missing some concerning details in the numbers.

A Closer Look At Sungei Bagan Rubber Company (Malaya) Berhad's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

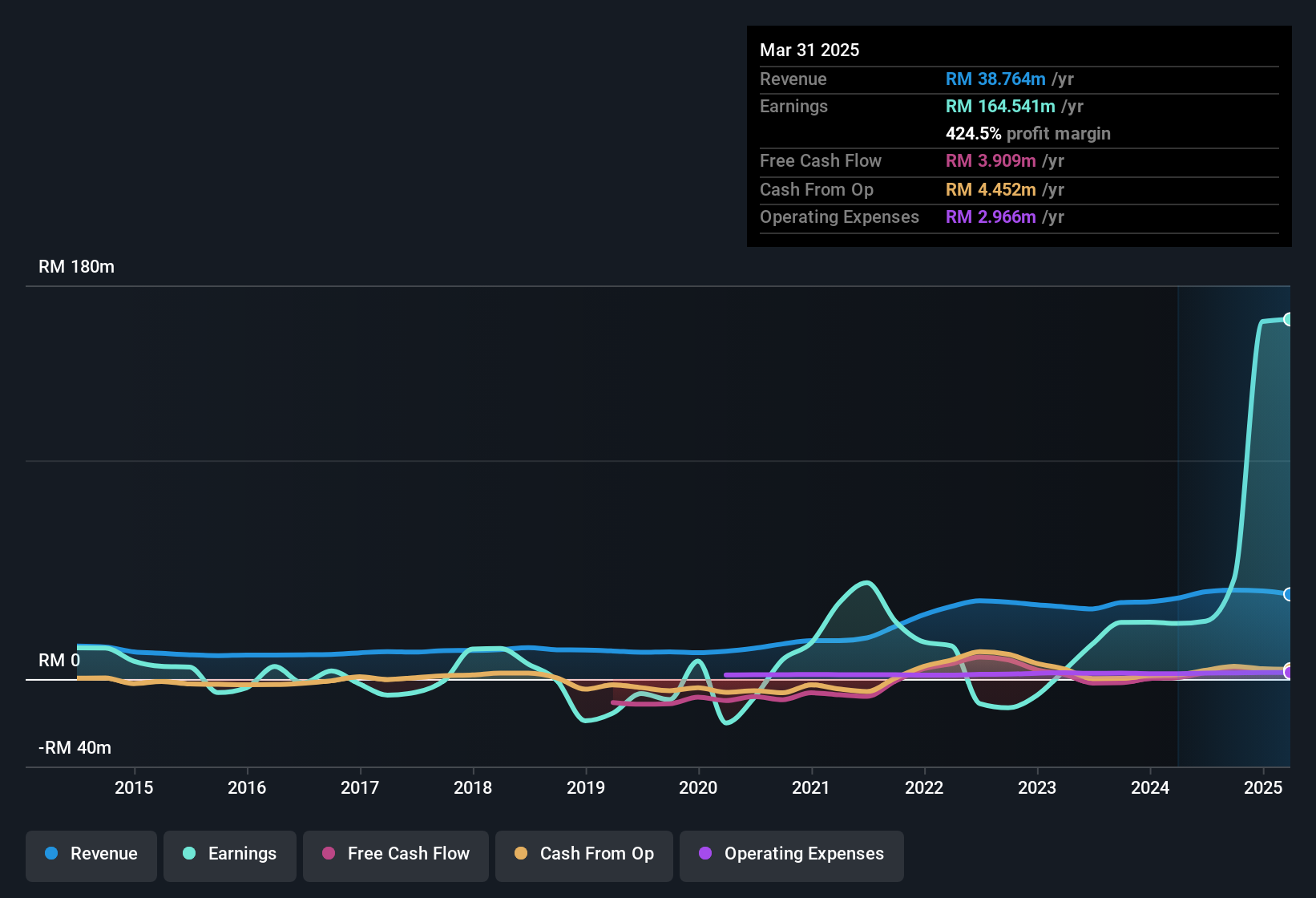

Sungei Bagan Rubber Company (Malaya) Berhad has an accrual ratio of 0.23 for the year to March 2025. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. In fact, it had free cash flow of RM3.9m in the last year, which was a lot less than its statutory profit of RM164.5m. We note, however, that Sungei Bagan Rubber Company (Malaya) Berhad grew its free cash flow over the last year. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Sungei Bagan Rubber Company (Malaya) Berhad.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Sungei Bagan Rubber Company (Malaya) Berhad expanded the number of shares on issue by 40% over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Sungei Bagan Rubber Company (Malaya) Berhad's historical EPS growth by clicking on this link.

How Is Dilution Impacting Sungei Bagan Rubber Company (Malaya) Berhad's Earnings Per Share (EPS)?

Sungei Bagan Rubber Company (Malaya) Berhad has improved its profit over the last three years, with an annualized gain of 987% in that time. In comparison, earnings per share only gained 806% over the same period. And at a glance the 548% gain in profit over the last year impresses. On the other hand, earnings per share are only up 439% in that time. So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Sungei Bagan Rubber Company (Malaya) Berhad can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Sungei Bagan Rubber Company (Malaya) Berhad's Profit Performance

As it turns out, Sungei Bagan Rubber Company (Malaya) Berhad couldn't match its profit with cashflow and its dilution means that earnings per share growth is lagging net income growth. For the reasons mentioned above, we think that a perfunctory glance at Sungei Bagan Rubber Company (Malaya) Berhad's statutory profits might make it look better than it really is on an underlying level. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. At Simply Wall St, we found 2 warning signs for Sungei Bagan Rubber Company (Malaya) Berhad and we think they deserve your attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SBAGAN

Sungei Bagan Rubber Company (Malaya) Berhad

Produces and sells fresh oil palm fruit bunches in Malaysia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives