Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, PPB Group Berhad (KLSE:PPB) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for PPB Group Berhad

What Is PPB Group Berhad's Debt?

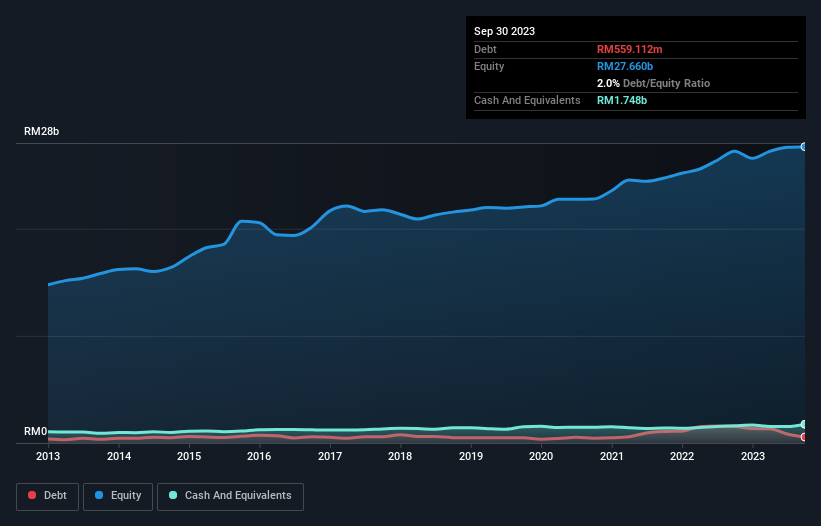

As you can see below, PPB Group Berhad had RM559.1m of debt at September 2023, down from RM1.54b a year prior. But it also has RM1.75b in cash to offset that, meaning it has RM1.19b net cash.

How Strong Is PPB Group Berhad's Balance Sheet?

The latest balance sheet data shows that PPB Group Berhad had liabilities of RM1.08b due within a year, and liabilities of RM594.2m falling due after that. On the other hand, it had cash of RM1.75b and RM942.4m worth of receivables due within a year. So it actually has RM1.02b more liquid assets than total liabilities.

This short term liquidity is a sign that PPB Group Berhad could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, PPB Group Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

Sadly, PPB Group Berhad's EBIT actually dropped 6.2% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if PPB Group Berhad can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. PPB Group Berhad may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last two years, PPB Group Berhad actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that PPB Group Berhad has net cash of RM1.19b, as well as more liquid assets than liabilities. The cherry on top was that in converted 113% of that EBIT to free cash flow, bringing in RM648m. So we don't have any problem with PPB Group Berhad's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for PPB Group Berhad that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PPB

PPB Group Berhad

An investment holding company, engages in the grains and agribusiness worldwide.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives