It's Down 26% But MSM Malaysia Holdings Berhad (KLSE:MSM) Could Be Riskier Than It Looks

MSM Malaysia Holdings Berhad (KLSE:MSM) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 183% in the last twelve months.

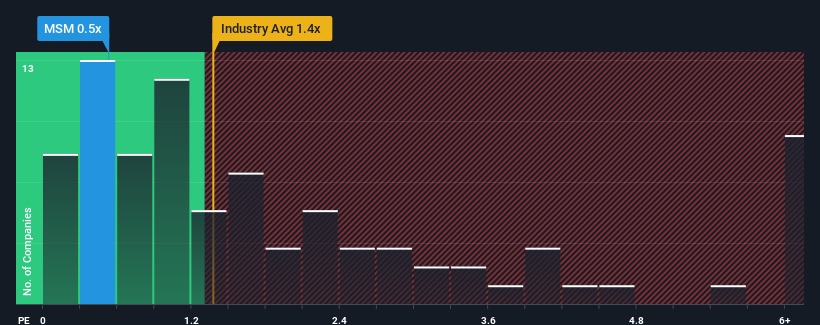

In spite of the heavy fall in price, when close to half the companies operating in Malaysia's Food industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider MSM Malaysia Holdings Berhad as an enticing stock to check out with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for MSM Malaysia Holdings Berhad

How Has MSM Malaysia Holdings Berhad Performed Recently?

MSM Malaysia Holdings Berhad certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. Those who are bullish on MSM Malaysia Holdings Berhad will be hoping that this isn't the case and the company continues to beat out the industry.

Keen to find out how analysts think MSM Malaysia Holdings Berhad's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as MSM Malaysia Holdings Berhad's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. The latest three year period has also seen an excellent 56% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 22% as estimated by the two analysts watching the company. With the industry only predicted to deliver 8.2%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that MSM Malaysia Holdings Berhad's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does MSM Malaysia Holdings Berhad's P/S Mean For Investors?

MSM Malaysia Holdings Berhad's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems MSM Malaysia Holdings Berhad currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for MSM Malaysia Holdings Berhad (1 shouldn't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MSM

MSM Malaysia Holdings Berhad

A refined sugar producer, produces, refines, markets, and sells refined sugar products in Malaysia.

Undervalued with moderate growth potential.

Market Insights

Community Narratives