Potential Upside For Malayan Flour Mills Berhad (KLSE:MFLOUR) Not Without Risk

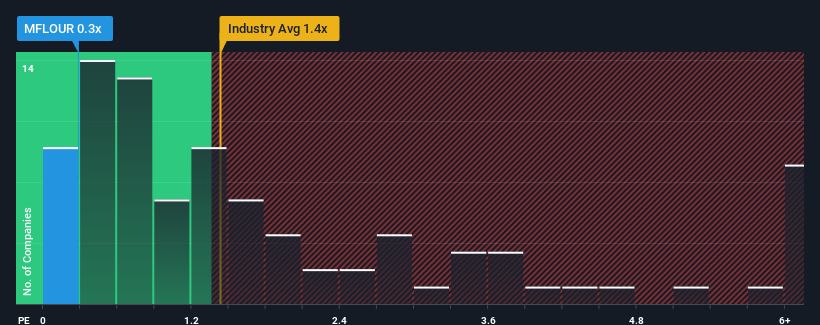

Malayan Flour Mills Berhad's (KLSE:MFLOUR) price-to-sales (or "P/S") ratio of 0.3x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Food industry in Malaysia have P/S ratios greater than 1.4x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Malayan Flour Mills Berhad

What Does Malayan Flour Mills Berhad's Recent Performance Look Like?

Recent times have been more advantageous for Malayan Flour Mills Berhad as its revenue hasn't fallen as much as the rest of the industry. One possibility is that the P/S ratio is low because investors think this relatively better revenue performance might be about to deteriorate significantly. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

Keen to find out how analysts think Malayan Flour Mills Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is Malayan Flour Mills Berhad's Revenue Growth Trending?

In order to justify its P/S ratio, Malayan Flour Mills Berhad would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.1%. Still, the latest three year period has seen an excellent 43% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 7.2% over the next year. Meanwhile, the rest of the industry is forecast to expand by 7.0%, which is not materially different.

With this in consideration, we find it intriguing that Malayan Flour Mills Berhad's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Malayan Flour Mills Berhad's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for Malayan Flour Mills Berhad remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Malayan Flour Mills Berhad that you need to be mindful of.

If you're unsure about the strength of Malayan Flour Mills Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:MFLOUR

Malayan Flour Mills Berhad

Operates in the flour milling industry in Malaysia and Vietnam.

Flawless balance sheet and fair value.

Market Insights

Community Narratives