Matang Berhad's (KLSE:MATANG) Stock Going Strong But Fundamentals Look Weak: What Implications Could This Have On The Stock?

Matang Berhad's (KLSE:MATANG) stock is up by a considerable 13% over the past month. However, we decided to pay close attention to its weak financials as we are doubtful that the current momentum will keep up, given the scenario. In this article, we decided to focus on Matang Berhad's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Matang Berhad

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Matang Berhad is:

0.9% = RM1.6m ÷ RM185m (Based on the trailing twelve months to June 2020).

The 'return' is the yearly profit. So, this means that for every MYR1 of its shareholder's investments, the company generates a profit of MYR0.01.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Matang Berhad's Earnings Growth And 0.9% ROE

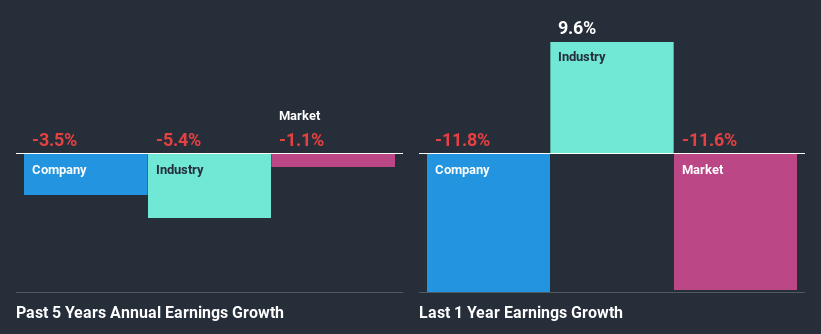

As you can see, Matang Berhad's ROE looks pretty weak. Even when compared to the industry average of 6.9%, the ROE figure is pretty disappointing. Therefore, it might not be wrong to say that the five year net income decline of 3.5% seen by Matang Berhad was possibly a result of it having a lower ROE. However, there could also be other factors causing the earnings to decline. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

As a next step, we compared Matang Berhad's performance with the industry and discovered the industry has shrunk at a rate of 5.4% in the same period meaning that the company has been shrinking its earnings at a rate lower than the industry. While this is not particularly good, its not particularly bad either.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Matang Berhad's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Matang Berhad Making Efficient Use Of Its Profits?

With a three-year median payout ratio as high as 156%,Matang Berhad's shrinking earnings don't come as a surprise as the company is paying a dividend which is beyond its means. Its usually very hard to sustain dividend payments that are higher than reported profits. To know the 4 risks we have identified for Matang Berhad visit our risks dashboard for free.

Additionally, Matang Berhad started paying a dividend only recently. So it looks like the management may have perceived that shareholders favor dividends even though earnings have been in decline.

Conclusion

On the whole, Matang Berhad's performance is quite a big let-down. The low ROE, combined with the fact that the company is paying out almost if not all, of its profits as dividends, has resulted in the lack or absence of growth in its earnings. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Matang Berhad's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you decide to trade Matang Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:MATANG

Matang Berhad

An investment holding company operating through its subsidiary that develops real estate properties.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives