Those Who Purchased Hwa Tai Industries Berhad (KLSE:HWATAI) Shares Three Years Ago Have A 64% Loss To Show For It

If you love investing in stocks you're bound to buy some losers. Long term Hwa Tai Industries Berhad (KLSE:HWATAI) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 64% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 37% lower in that time. Unfortunately the share price momentum is still quite negative, with prices down 25% in thirty days. But this could be related to poor market conditions -- stocks are down 25% in the same time.

View our latest analysis for Hwa Tai Industries Berhad

Because Hwa Tai Industries Berhad made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Hwa Tai Industries Berhad grew revenue at 1.4% per year. That's not a very high growth rate considering it doesn't make profits. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 29% during the period. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). After all, growing a business isn't easy, and the process will not always be smooth.

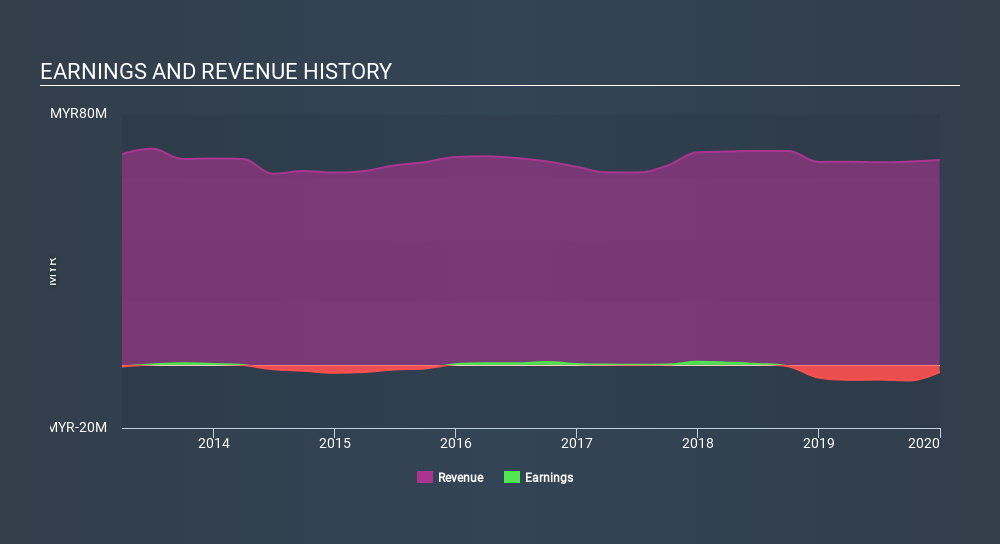

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 27% in the twelve months, Hwa Tai Industries Berhad shareholders did even worse, losing 37%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 14% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Hwa Tai Industries Berhad (including 2 which is are a bit concerning) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:HWATAI

Hwa Tai Industries Berhad

An investment holding company, engages in the manufacture and trading of biscuits and other confectionery products in Malaysia.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives