Farm Fresh Berhad (KLSE:FFB) Stocks Shoot Up 26% But Its P/E Still Looks Reasonable

Despite an already strong run, Farm Fresh Berhad (KLSE:FFB) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 32%.

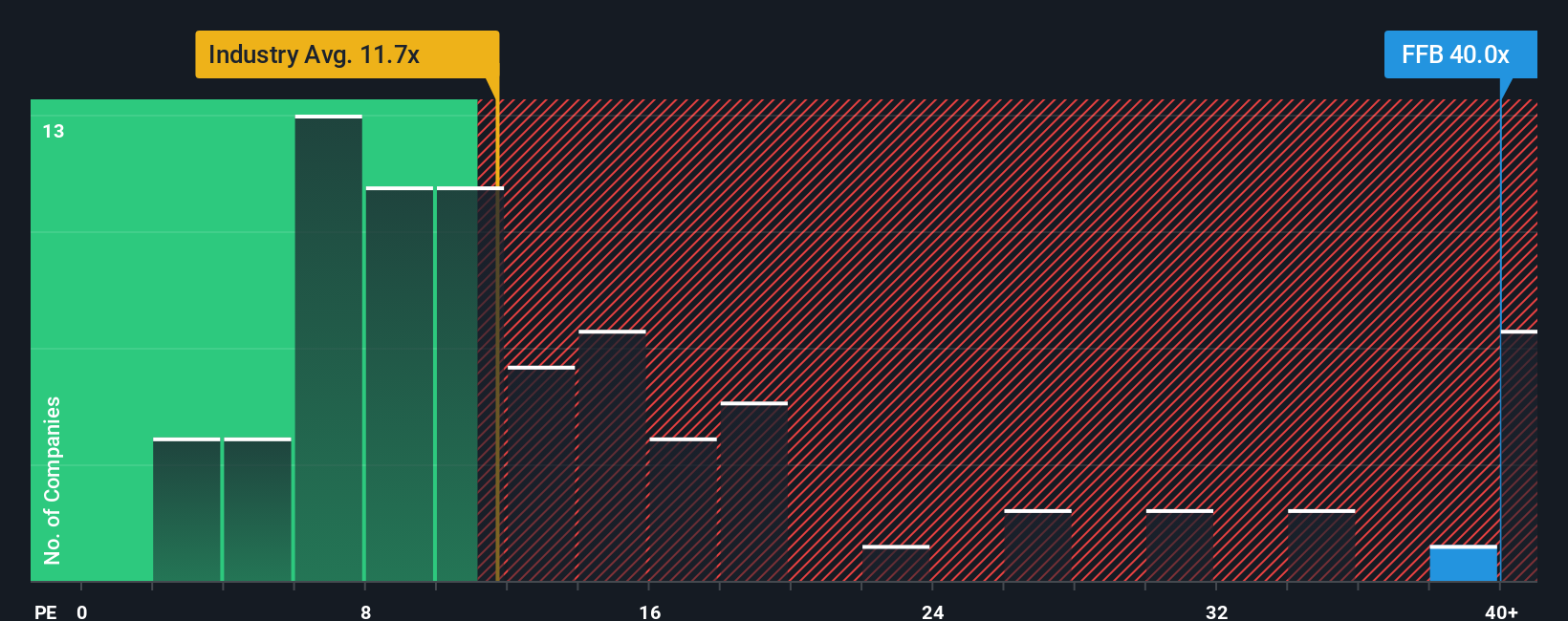

After such a large jump in price, given close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 14x, you may consider Farm Fresh Berhad as a stock to avoid entirely with its 40x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Farm Fresh Berhad as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Farm Fresh Berhad

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Farm Fresh Berhad's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 36%. The strong recent performance means it was also able to grow EPS by 35% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 15% each year during the coming three years according to the analysts following the company. With the market only predicted to deliver 12% per year, the company is positioned for a stronger earnings result.

With this information, we can see why Farm Fresh Berhad is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Farm Fresh Berhad's P/E

Shares in Farm Fresh Berhad have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Farm Fresh Berhad's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Farm Fresh Berhad with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:FFB

Farm Fresh Berhad

Engages in the production, marketing, and sale of cow’s milk and plant-based related products in Malaysia, Australia, Singapore, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives