- Malaysia

- /

- Oil and Gas

- /

- KLSE:STRAITS

Earnings Not Telling The Story For Straits Energy Resources Berhad (KLSE:STRAITS)

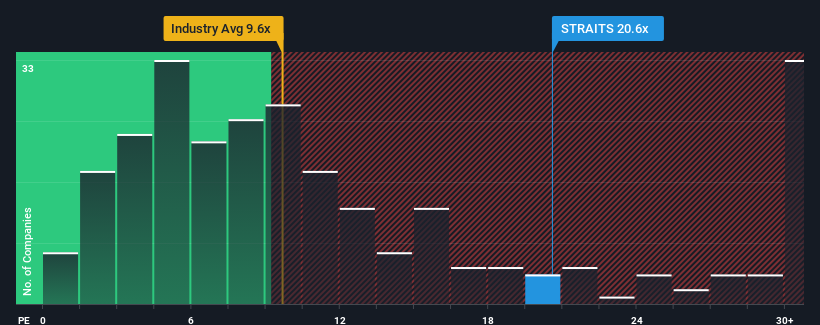

When close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 15x, you may consider Straits Energy Resources Berhad (KLSE:STRAITS) as a stock to potentially avoid with its 20.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

As an illustration, earnings have deteriorated at Straits Energy Resources Berhad over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Straits Energy Resources Berhad

How Is Straits Energy Resources Berhad's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Straits Energy Resources Berhad's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 24%. The last three years don't look nice either as the company has shrunk EPS by 15% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's an unpleasant look.

In light of this, it's alarming that Straits Energy Resources Berhad's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Straits Energy Resources Berhad currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with Straits Energy Resources Berhad.

If you're unsure about the strength of Straits Energy Resources Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:STRAITS

Straits Energy Resources Berhad

An investment holding company, provides oil trading and bunkering services in Malaysia.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.