- Malaysia

- /

- Energy Services

- /

- KLSE:PERDANA

While shareholders of Perdana Petroleum Berhad (KLSE:PERDANA) are in the black over 3 years, those who bought a week ago aren't so fortunate

It's been a soft week for Perdana Petroleum Berhad (KLSE:PERDANA) shares, which are down 10%. In contrast, the return over three years has been impressive. The share price marched upwards over that time, and is now 235% higher than it was. To some, the recent share price pullback wouldn't be surprising after such a good run. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the long term performance has been good but there's been a recent pullback of 10%, let's check if the fundamentals match the share price.

View our latest analysis for Perdana Petroleum Berhad

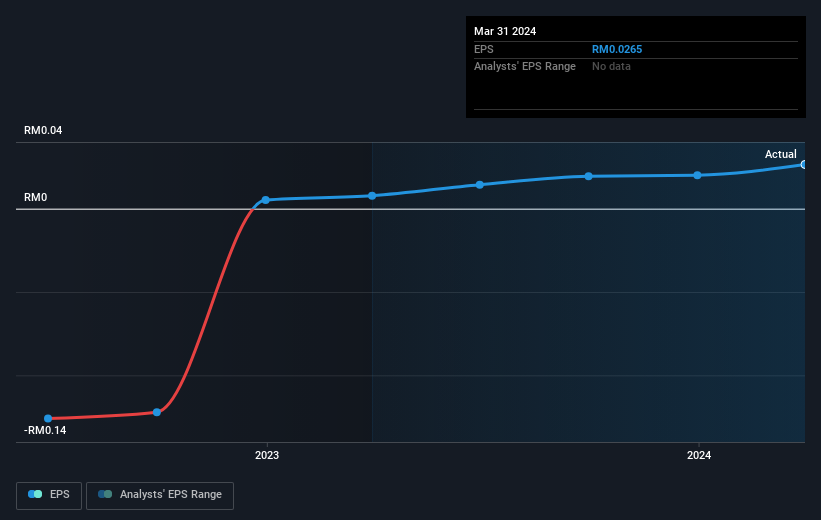

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Perdana Petroleum Berhad moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Perdana Petroleum Berhad's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Perdana Petroleum Berhad shareholders have received a total shareholder return of 149% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 7% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Perdana Petroleum Berhad better, we need to consider many other factors. For instance, we've identified 1 warning sign for Perdana Petroleum Berhad that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:PERDANA

Perdana Petroleum Berhad

An investment holding company, provides offshore marine support services for the upstream oil and gas industry in Malaysia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives