- Malaysia

- /

- Energy Services

- /

- KLSE:PERDANA

Subdued Growth No Barrier To Perdana Petroleum Berhad (KLSE:PERDANA) With Shares Advancing 29%

Perdana Petroleum Berhad (KLSE:PERDANA) shares have continued their recent momentum with a 29% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 78% in the last year.

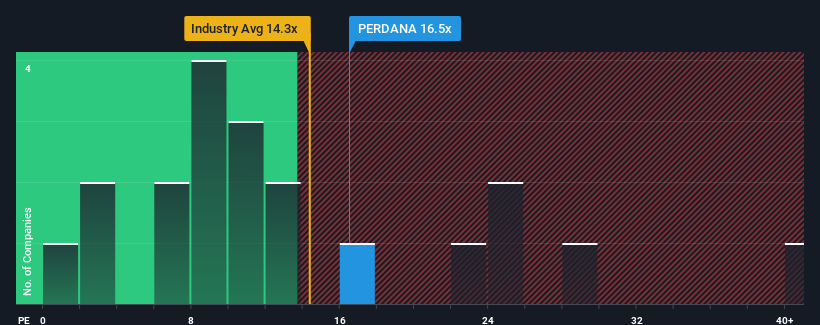

Although its price has surged higher, it's still not a stretch to say that Perdana Petroleum Berhad's price-to-earnings (or "P/E") ratio of 16.5x right now seems quite "middle-of-the-road" compared to the market in Malaysia, where the median P/E ratio is around 16x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been quite advantageous for Perdana Petroleum Berhad as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Perdana Petroleum Berhad

How Is Perdana Petroleum Berhad's Growth Trending?

The only time you'd be comfortable seeing a P/E like Perdana Petroleum Berhad's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 294%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 17% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that Perdana Petroleum Berhad is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Bottom Line On Perdana Petroleum Berhad's P/E

Perdana Petroleum Berhad appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Perdana Petroleum Berhad revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Perdana Petroleum Berhad with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PERDANA

Perdana Petroleum Berhad

An investment holding company, provides offshore marine support services for the upstream oil and gas industry in Malaysia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.